How to Know If You Have Enough Money to Retire? The real truth is that you don’t retire on a “number.” You retire on reliable cash flow that covers your lifestyle forever. Here’s the battle-tested, precise method—so you can stop guessing. In the next few minutes, we will provide a detailed guide to help you dial it in. By the end, you’ll know whether work is optional—and the exact levers to pull if it isn’t.

Detailed Step-by-Step Guide on How to Know If You Have Enough Money to Retire

Estimate Annual Spending in Retirement (today’s dollars)

Goal: land on a realistic annual spend number using today’s dollars so you don’t have to do inflation math.

Two quick methods

Bottom-up (best): List categories and total them.

Core (non-negotiable): housing (rent/mortgage, taxes, HOA), utilities, groceries, transportation, insurance (home/auto), healthcare (premiums + out-of-pocket), phone/internet.

Lifestyle (flexible): dining out, travel, hobbies, gifts, entertainment, upgrades.

Top-down (fast): Take your current spending, subtract work costs (commute, lunches, child care if it ends), add new retirement activities (more travel, hobbies).

Monthly shortcut: estimate monthly → × 12.

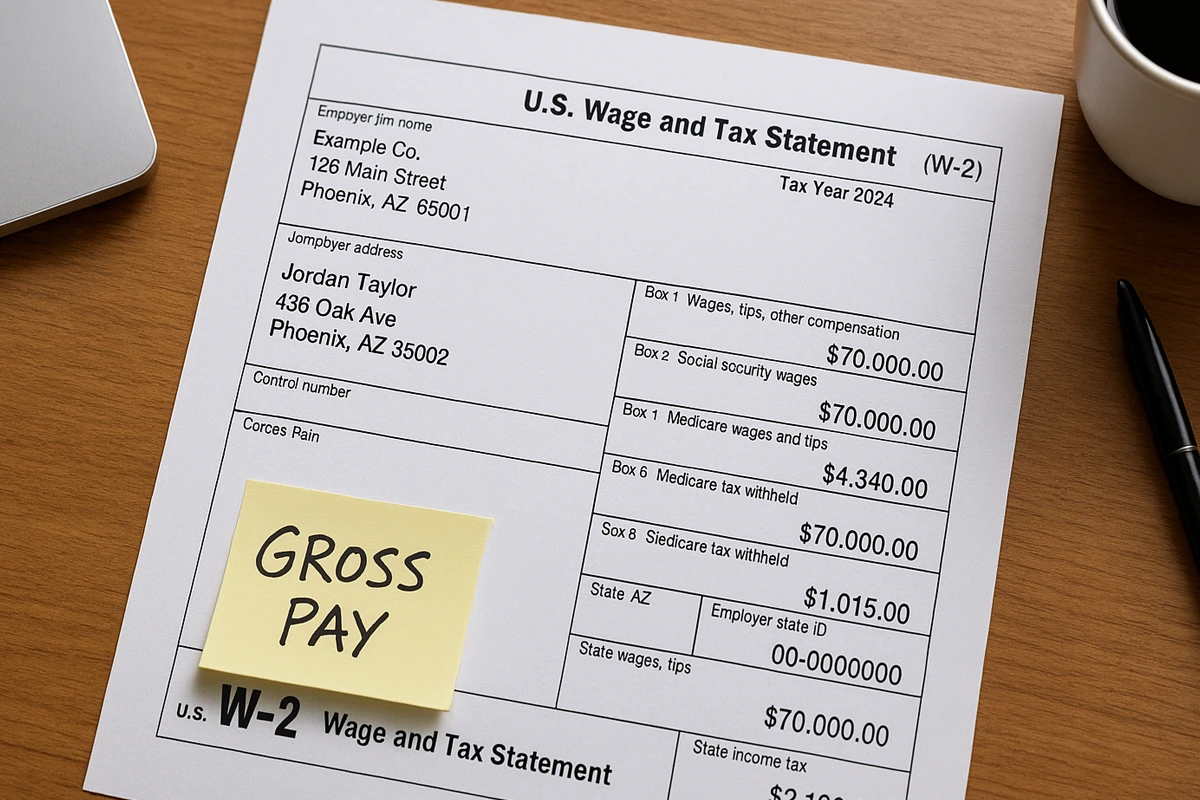

Example: $5,833/month → $70,000/yr.

Sanity check: If your home will be paid off, drop that payment (but keep taxes/insurance/maintenance). If you’ll retire before Medicare, add separate health insurance for the bridge years.

Subtract Guaranteed Income

Goal: reduce the portfolio’s workload by accounting for income that isn’t market-dependent.

What counts

Social Security (per person, planned start age)

Pensions/annuities (note if inflation-adjusted)

Net rental income (after mortgage interest, taxes, insurance, maintenance, management, and vacancies)

What does not belong here

Dividends/interest from your portfolio. Those are already captured in your withdrawal rate. Listing them here double-counts.

Conservative move (especially if you’re younger):

Model 0–50% of your Social Security for planning, then re-add later as you get closer. Better to be pleasantly surprised than short.

Example

$70,000 spending − $28,000 guaranteed = $42,000 gap

Pick a Conservative Withdrawal Rate

Goal: Lock in a withdrawal rule and initial rate that matches your risk tolerance.

This is the percent of your portfolio you plan to withdraw in year one (in real, inflation-adjusted terms), then increase with inflation each year.

Good range: 3.0%–4.0%

If you want simple & conservative, use 4.0% only if you’re comfortable with small cutbacks in bad markets; otherwise 3.5% gives extra cushion.

If you’ll adjust spending (trim 5–10% after rough years), you can justify the higher end of the range.

(Your draft had a typo: “This man” → you meant “This means your withdrawals rise with inflation each year.”)

Research on “how much can I withdraw?”

Morningstar 2025 safe-withdrawal research — recent baseline ~3.7% with assumptions; great context. Suggested anchor: “Latest safe withdrawal rate research.” Morningstar

Bengen (1994) original 4% paper — historical “SAFEMAX” foundation. Anchor: “Bengen 4% rule.” Financial Planning Association

Compute Your Target Nest Egg

Goal: Produce your exact Required Portfolio in today’s dollars.

Formula:

Required Portfolio = Gap ÷ Withdrawal Rate

Example: $42,000 ÷ 0.04 = $1,050,000

Tax reality check:

If most of your withdrawals will come from pre-tax accounts (401k/Traditional IRA), gross the gap up by an estimated effective tax rate (e.g., 10–15%).

Quick version: Required = (Gap ÷ (1 − tax rate)) ÷ withdrawal rate

Add a Margin of Safety

Goal: Produce your exact Required Portfolio in today’s dollars.

Life throws curveballs (healthcare spikes, a roof, helping family, sequence risk). Pad the plan.

Add 10–20% to the required portfolio.

Higher end (15–20%) if: heavy pre-tax accounts, retiring early, low guaranteed income, or you want zero spending cuts in bad markets.

Example: $1,050,000 × 1.20 = $1,260,000

Example Wrap Up (All Steps)

- Spending (today’s $): $70,000

- Guaranteed income: $28,000

- Gap: $42,000

- Withdrawal rate: 4%

- Required: $42,000 ÷ 0.04 = $1,050,000

- Safety margin (20%): $1,260,000 target

Pro Tips & Gotchas

Pro Tips (do these)

- Plan in today’s dollars. Keep all inputs in today’s $ and use a real withdrawal rate (3.0–4.0%). Way simpler; fewer mistakes.

- Split spending: Core (must-haves) vs Flexible (nice-to-haves). Pre-decide what you’ll trim 5–10% in bad markets.

- Guardrails beat guesswork. Start near 4%, cut/raise ~10% after bad/good years, with floors/ceilings. More runway with the same money.

- Defense vs sequence risk: Hold 1–2 years of core expenses in cash/T-Bills; refill from gains after up years.

- Taxes: plan the mix. Compute an after-tax gap (if heavy pre-tax, gross up by ~10–15%). Use Roth conversions in low-income years before RMDs.

- Healthcare math: Price pre-65 coverage and OOP separately from post-65 Medicare. Build a small healthcare buffer line item.

- Asset mix matters: Many retirees land 50–70% equities for growth, with quality bonds/T-Bills for stability. Rebalance annually or at 5/25% drift.

- Fees are silent killers: Every 1% of fees eats 25% of a 4% withdrawal. Use low-cost index funds; scrutinize advisory layers.

- Model rentals correctly: Use net (after mortgage interest, taxes, insurance, maintenance, cap-ex, vacancy, management).

- One-offs & sinking funds: Plan ahead for roof, car, weddings, big travel. Better as earmarked buckets than “oops” later.

- Social Security sanity: Younger? Plan with 0–50% of SS; firm it up as you approach filing. Higher earner often benefits from delaying to age 70.

- Home equity is optional safety, not plan A. Downsizing or a HELOC can be a backstop—don’t count it twice.

Gotchas (avoid these)

- Double-counting dividends/interest. They’re part of portfolio returns and already baked into your withdrawal rate.

- Using gross rents. Gross ≠ spendable. Model net or you’ll understate your gap.

- Ignoring taxes/RMDs. Pre-tax money isn’t all yours. RMDs can push you into higher brackets and Medicare surcharges.

- Underestimating healthcare & LTC risk. Premiums and OOP jump; long-term care can be six figures. That’s what the margin of safety is for.

- Too little equity. A “safe” 20–30% stock mix can quietly kill longevity. You still need growth.

- Assuming straight-line returns. Markets wobble. Test your plan with guardrails or a simple Monte Carlo.

- Forgetting survivor math. When one spouse dies, SS/pension cash flow changes—but many costs don’t.

- Mortgage confusion. If you’ll pay it off, remove the payment but keep taxes/insurance/maintenance.

- No cash buffer. Being forced to sell in a downturn is how good plans fail.

- Set-and-forget. Review yearly or after big life changes; adjust spending, taxes, or asset mix as needed.

Conclusion: Your Next 10 Minutes

If you’ve read this far, you now know How to Know If You Have Enough Money to Retire: estimate spending (today’s $), subtract guaranteed income, pick a conservative withdrawal rate, compute the number, add a safety margin. Simple. Repeatable. Honest.

Now act:

- Run the 5-minute test with your numbers.

- Write down your withdrawal rule (3.5% default or guardrails).

- Set your cash buffer (12–24 months of core expenses).

If your assets meet—or beat—your target, congrats: you’re work-optional. If you’re short, pull the big levers (delay 1–3 years, trim the gap, add guaranteed income). Once you reach the number, then you can refocus on padding your lifestyle or speeding up your retirement timeline. If you want to speed up your timeline, then you might want to check out our free Net Worth Accelerator.