The Eye-Opening Truth: Over half of Americans don’t even know how to calculate their net worth, and nearly one-third have a net worth at or below $0. This isn’t just a statistic – it’s a wake-up call. creditkarma.com

What Is Net Worth?

It’s the sum of everything you own minus everything you owe. In other words: Assets – Liabilities = Net Worth. This single number is like your financial report card – it shows your overall financial health at a glance.

Net Worth = Assets - Liabilities

Analogy (Gardening): Your net worth is like a garden you’re cultivating. Regularly checking it is like watering plants, pulling weeds, and planting seeds. Neglect it, and weeds (debt, poor spending habits) take over. Tend it carefully, and you’ll harvest wealth and financial freedom.

It’s not the only measure of financial well-being, but it’s a crucial one.

Why This Article?

Whether you’re a beginner just starting out or an expert fine-tuning your finances, understanding and tracking net worth is key. In this guide, we’ll explore why tracking your net worth matters – from basics like categorizing assets and debts to advanced insights on growth benchmarks, psychology, and compounding. You’ll also discover the best tools (from simple spreadsheets to cutting-edge apps) to make net worth tracking easy and even fun.

Have you ever wondered how much money you have in total? Not just the cash in your wallet or your piggy bank, but everything you own and owe? That total amount is called your net worth. Tracking your net worth is like having a financial report card, and it’s super important for a few reasons. Let’s dive in and see why keeping an eye on your net worth matters!

First, We Need to Understand What is Money?

Money is simply a tool—a magnifier that amplifies who you already are and what you already do. If you’re generous, having more money makes generosity easier; if you’re disciplined, it becomes rocket fuel, accelerating your progress toward your goals. Money itself isn’t good or bad—it’s neutral, shaped entirely by the hands that hold it. It’s like fire: it can warm your house or burn it down, depending on how you manage it. Ultimately, mastering money means mastering yourself, turning your potential into reality.

What Net Worth Isn’t

Net worth, on the other hand, is not a measure of your worth as a person, your happiness, or your success in life. It isn’t determined by how impressive your lifestyle appears, how much stuff you own, or how much you earn annually. Net worth isn’t a competition or something to flaunt; it’s not about looking wealthy but about truly being financially secure. It doesn’t automatically indicate financial wisdom—someone with high net worth can still make poor financial decisions. Above all, net worth isn’t static; it’s a snapshot of your current financial position, not your destiny. Some use it for motivation, but most importantly, it should be used as a path to self-discovery and improvement.

Net Worth Basics: Assets, Liabilities, and How to Calculate

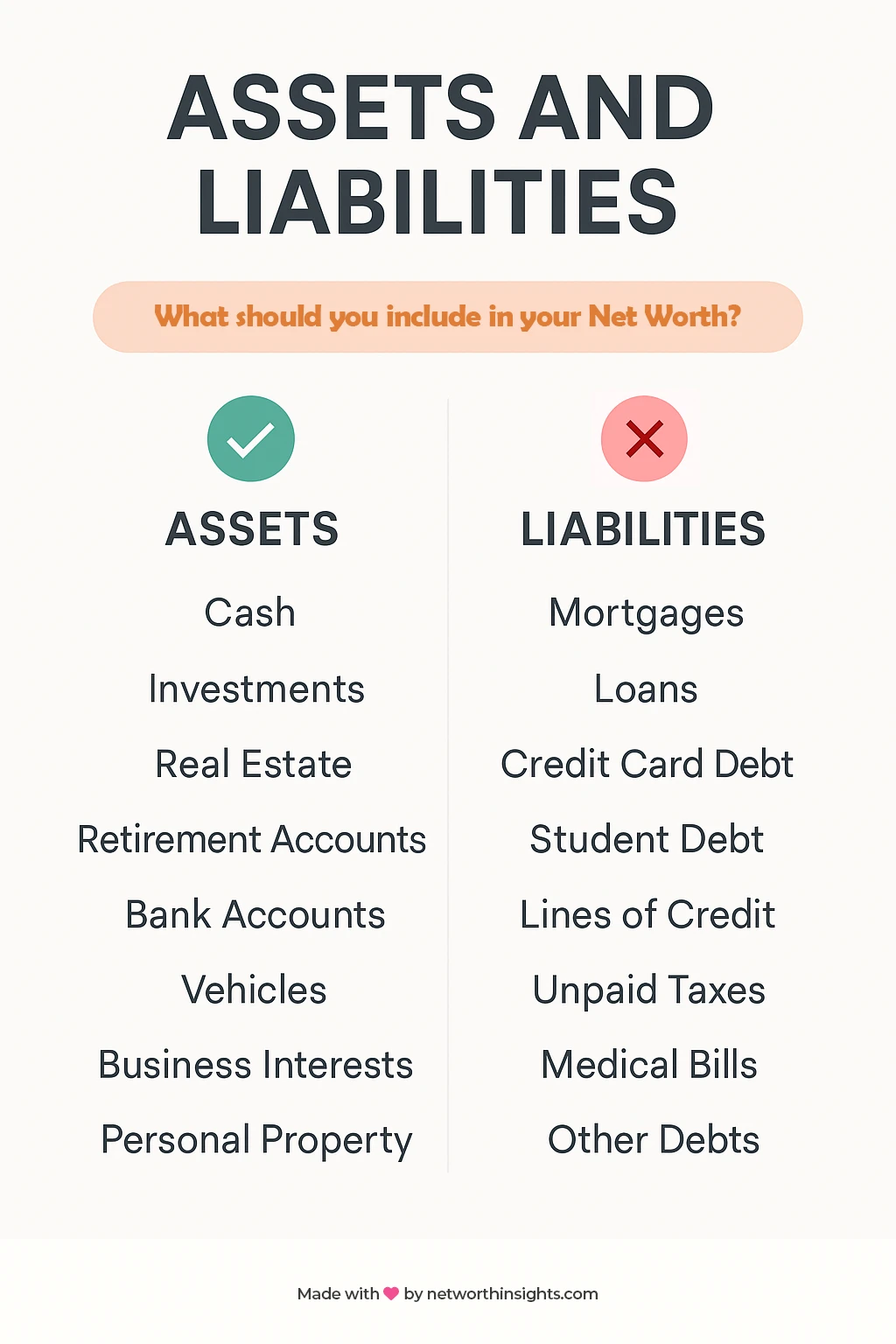

- Defining Assets and Liabilities: To track net worth, you need to know what to include. Assets are everything valuable you own – cash, investments, real estate, retirement accounts, vehicles, etc.

- Liabilities are all your debts – mortgage, student loans, credit cards, car loans, etc.

- Example: Your home (asset) minus the mortgage on it (liability) contributes to your net worth. A $300,000 house with a $200,000 mortgage adds $100,000 to your net worth.

- Tip: Don’t count everyday belongings with little resale value (clothes, basic furniture) – focus on assets that truly contribute (bank balances, investments, property equity). Also exclude your monthly bills/expenses; only outstanding debts count as liabilities.

- How to Calculate Net Worth: It’s straightforward arithmetic: Total Assets – Total Liabilities. Make a list of all asset values, sum them up, then subtract all debts. The result can be positive (you own more than you owe) or negative (you owe more than you own).

- If you’ve never done this, start with a basic list: cash in the bank, investments, car value, home value, etc., and credit card balances, loans, etc. Then, do the math. Even if the number is small or negative, it’s better to know it.

- Snapshot vs. Trend: Remember, a net worth calculation is a snapshot of today. Its real power comes from tracking it over time. A single calculation is less meaningful without context. In the next section, we’ll see how monitoring changes month-to-month or year-to-year uncovers the true story of your financial progress.

(Note: This section ensures even a beginner understands net worth fundamentals. Feel free to include a simple graphic or chart illustrating assets minus liabilities equaling net worth, for visual learners.)

Why Tracking Your Net Worth Matters – Key Benefits

Tracking your net worth isn’t just a nerdy finance exercise – it can fundamentally change how you approach money. Let’s dive into the big reasons why it matters (for newbies and seasoned pros alike):

Clear Financial Picture (Your “Money Health” Score)

- Financial Health Indicator: Net worth acts like your financial “vitals.” Just as blood pressure indicates physical health, your net worth indicates financial health. It’s a single number aggregating all your financial choices – the good, bad, and ugly – into an easy-to-understand metric.

- See Everything in One Place: When you track net worth, you see the forest, not just the trees. All accounts and obligations together show the big picture. This comprehensive view can reveal things you might miss when looking at accounts in silos. For example, a healthy bank balance might feel good until you see it alongside mounting credit card debt – net worth puts it all in perspective.

- Spot Financial Trends: Tracking net worth over time lets you spot trends in your finances. Is your overall wealth growing or shrinking? Are you better off than a year ago? Seeing a net worth chart trending upward can be highly motivating, while a flat or downward trend can be a timely warning to adjust your habits.

- Benchmarking (With Caution): It’s natural to wonder “How am I doing compared to others?” The median net worth for U.S. families is about $192,700 (the mean is over $1 million, skewed by the very wealthy). By age, net worth typically grows until retirement. Comparing to broad benchmarks can give you context – e.g., are you on track for your age group – but don’t obsess over others’ numbers. Use benchmarks as gentle reference points, not as strict targets (we’ll discuss comparison pitfalls later).

Example: At 30, Alice calculates her net worth is $20,000. She learns the average net worth for Americans under 35 is around $11,000, so she’s doing okay, but not complacent. Tracking her net worth yearly, she aims to beat her personal last-year’s number rather than someone else’s. kubera.com

Goal Setting and Motivation

- Turning Dreams into Targets: When you know your net worth, you can set tangible financial goals and measure progress. It’s hard to plan for “financial freedom” abstractly – but if you know your net worth today, you can set a goal for what you want it to be next year or in five years. Tracking gives specificity to your goals.

- Breakdown Big Goals: Net worth tracking helps break down big goals (like buying a home, retiring early, becoming a millionaire) into incremental progress. For example, if your goal is a net worth of $100K and you’re at $40K now, seeing that progress inch up each month (50K…60K…) keeps you focused and encouraged.

- Psychological Boost: There’s a behavioral psychology aspect: seeing your efforts translate into a growing net worth provides positive reinforcement. Paying off $5,000 of debt might feel abstract, but when you update your net worth and see it jump up by the same $5,000, it’s concrete proof of progress. That reward can reinforce good habits.

- Relatable Analogy: This is similar to tracking weight loss or fitness milestones. Checking in regularly and seeing improvement (even small) motivates you to stick with good habits. In finance, tracking net worth can encourage you to save more, spend smarter, and invest consistently, because you can literally see the results.

- Accountability: Regular check-ins with your net worth number create a sense of accountability. It’s like having a monthly financial “weigh-in.” If you know you’ll be logging your net worth, you might think twice about that impulse purchase or taking on new debt, because you’ll see the impact at month’s end. It turns abstract money moves into visible outcomes.

- Achieving Milestones: Celebrating milestones becomes fun. First $0 net worth (out of debt), first $100K, etc. Many people find tracking addictive in a good way – it becomes a game where net worth is the score. In fact, personal finance communities often share net worth updates as a way to stay motivated and accountable (J. Money of BudgetsAreSexy famously shared his net worth every month for years as motivation).

Better Financial Habits and Awareness

- Awareness Leads to Improvement: “What gets measured gets managed,” as the old saying goes. By measuring your net worth regularly, you naturally become more conscious of your money decisions. You start to see how saving an extra $100 or paying off a credit card affects your bottom line. This awareness can lead to healthier financial habits. boldin.com

– like budgeting, cutting unnecessary expenses, or finding ways to earn more. - Spending vs. Investing Perspective: Tracking net worth shifts your mindset from just “monthly spending” to “long-term wealth building.” For instance, you might feel good about buying a new $1,000 phone, but seeing that as a $1,000 drop in net worth paints a different picture. Conversely, investing $1,000 and watching your net worth grow reinforces investing behavior. It reframes decisions in terms of impact on your wealth, not just immediate gratification.

- Encourages Debt Reduction: When you track how debt payoff boosts your net worth, it can supercharge your motivation to eliminate liabilities. For example, each student loan payment not only reduces that debt balance but directly lifts your net worth (because liabilities went down). This can turn debt payoff into a rewarding game rather than a chore.

- Holistic View of Finances: Net worth forces you to look at everything together. Many people focus only on one aspect (like trying to save more, or just paying down debt) without seeing the interplay. Net worth tracking shows how all the moving parts of your finances connect. This holistic view can lead to more balanced decisions – maybe you realize that aggressively paying off a 3% mortgage while neglecting 401(k) investing isn’t actually growing your net worth optimally.

- Behavioral Changes: Some studies in behavioral finance suggest that regular financial check-ins can improve outcomes, similar to how dieters who weigh themselves frequently tend to lose more weight. Tracking net worth monthly or quarterly can create a habit loop: you see results, feel in control, and that drives you to continue good behaviors (like saving and investing). Essentially, it taps into our psychology by providing immediate feedback on our long-term actions.

Informed Decision-Making & Planning

- Big Picture for Big Decisions: When you know your net worth, you’re better equipped to make major financial decisions. It provides context for questions like “Can I afford this house?” “Is my investment strategy working?” “Am I on track for retirement?” For example, seeing that a home purchase would make your net worth drop or become too house-heavy might urge caution.

- Goal-Based Planning: Suppose you want to buy a home or start a business – knowing your net worth helps you plan. If you have $50K net worth and a lot of that is cash, you might allocate, say, $30K for a down payment and know you’d still have a buffer left. Or if your net worth is mostly tied up in a 401(k) and home equity, you might realize you’re asset-rich but cash-poor, affecting your decision.

- Measuring Debt Impact: Net worth puts debt in perspective. A $20,000 car loan sounds huge in isolation, but if your net worth is $300,000, it’s manageable. On the flip side, $20,000 in debt with only $5,000 in assets shows an unhealthy situation. This context helps you decide if taking on new debt is wise. As one guideline, some experts (like those at Financial Samurai) suggest keeping certain debts within limits – e.g., try to keep your home’s value between 35%–50% of your net worth kubera.com

. That way, you’re not over-leveraged in one asset. With net worth tracking, you can apply such rules of thumb to your own finances to stay on track. - Investment Performance & Allocation: By tracking net worth, you can evaluate how your investments are contributing. Rather than checking each account separately, look at their effect on your total wealth. If your net worth jumps significantly in a quarter, was it because your stocks did well, or you saved aggressively, or you sold an asset? If it drops, was it a market dip? Net worth acts as an umbrella metric that can signal when to dig deeper. For instance, if despite saving money your net worth isn’t growing, maybe an investment is underperforming or debt interest is dragging it down.

- Long-Term Planning & Life Changes: Regular net worth monitoring prepares you for life events. Whether it’s having kids, changing careers, or facing an emergency, seeing your net worth over time helps you gauge if you’re financially ready. It can also inform retirement planning: If your net worth isn’t growing fast enough to meet your retirement goal, you get an early warning to adjust (save more, invest differently, or reconsider retirement age). In short, net worth is a compass that helps guide major financial directions.

Long-Term Progress and The Power of Compounding

- Track Your Progress to Financial Freedom: Each net worth update is like a checkpoint on your journey to financial independence. In the beginning, progress might feel slow – but as your net worth grows, the growth itself accelerates thanks to compounding. Tracking net worth lets you actually witness this compound effect over years.

- Compound Growth Illustrated: For example, if you invest $5,000 a year, your net worth doesn’t just increase by $5,000 annually. Your investments earn returns, which then earn their own returns. If you track annually, you’ll notice your net worth curve bending upwards over time. The first $100K might have taken 5+ years, but the next $100K could take much less as investments compound. Seeing this happen reinforces why investing early and consistently matters.

- Data example: Suppose at age 25 you start with $0 and invest $5,000/year at a 7% return. By 35, you might see ~$70K net worth. By 45, perhaps ~$210K. By 55, around ~$460K. The growth from 45 to 55 (when your investments really kick into gear) will dwarf the growth from 25 to 35. Tracking those milestones makes the power of compounding real, not just theoretical.

- Staying Focused on Long Term: When markets swing or you face a setback (job loss, big expense), net worth tracking can provide reassurance. Maybe your net worth dips this month, but looking at a 5-year chart reminds you how far you’ve come. This long-term perspective can prevent panic and short-term thinking (like selling investments in a downturn). It encourages you to stay the course because the trend over time – if you’re doing the right things – should be upward.

- Motivational Milestones: As your net worth grows, you’ll hit significant milestones that reflect compounding. The first time your investments earn more in a year than you contributed, or when your debt payoff suddenly frees up cash that boosts savings – celebrate these wins. They are evidence that wealth builds momentum. Tracking lets you appreciate that momentum, which is incredibly motivating to keep going.

Relating Net Worth to Life Goals and Values

- Connecting Money to Goals: Ultimately, the reason net worth matters is because it’s tied to your life goals. It’s not about the number for number’s sake – it’s what that number means for your financial freedom and choices. Tracking net worth keeps your goals (buying a home, traveling, retiring comfortably, etc.) on the radar. For example, if you know you want to retire early with a certain net worth, watching your progress can tell you if you’re on pace or need to adjust.

- Measure of Financial Independence: Many people use net worth as a gauge for when they can be work-optional. A common rule of thumb is the 4% rule for retirement – roughly, when your net worth invested can yield enough annual income to cover expenses (net worth ≈ 25× annual expenses). By tracking net worth, you can see how close you are to that kind of milestone.

- Values and Choices: Tracking net worth can also spark discussions about what you value. You might realize, for instance, that spending $5,000 on a luxury vacation will set back your net worth trajectory and decide if it’s worth it to you. There’s no right or wrong answer – maybe it is worth it for the life experience! The point is that by being aware of the impact on your wealth, you make intentional choices aligned with your values (rather than spending or saving blindly).

- Legacy and Security: Over time, net worth isn’t just about you – it can enable providing for family or causes you care about. Monitoring it can ensure you’re building a legacy if that’s a goal (e.g., you want to fund college for your kids or leave something for heirs or charity). If your net worth growth is lagging, you know to course-correct in your planning or investments to meet those future commitments.

- Motivation with Purpose: Always remember, net worth is a means to an end, not the end itself. Tracking it is valuable because it helps you live the life you want. Keep your life goals front and center when looking at your net worth. It adds meaning to the numbers and keeps you motivated to improve them for the right reasons (not just to “be rich,” but to achieve what being financially secure allows you to do).

How to Track Your Net Worth

You can use a notebook, a spreadsheet, or even apps designed to help you track your net worth. Tracking your net worth doesn’t have to be complicated. Here are some simple steps to get started:

Calculate Your Net Worth Once – Today

Using the basics from above, sit down and do that first calculation. List out your assets and liabilities, get the totals, and find out your number. It might be tempting to procrastinate, but remember, knowledge is power. Even if it’s not a number you’re proud of yet, this is your starting point – and everyone starts somewhere.

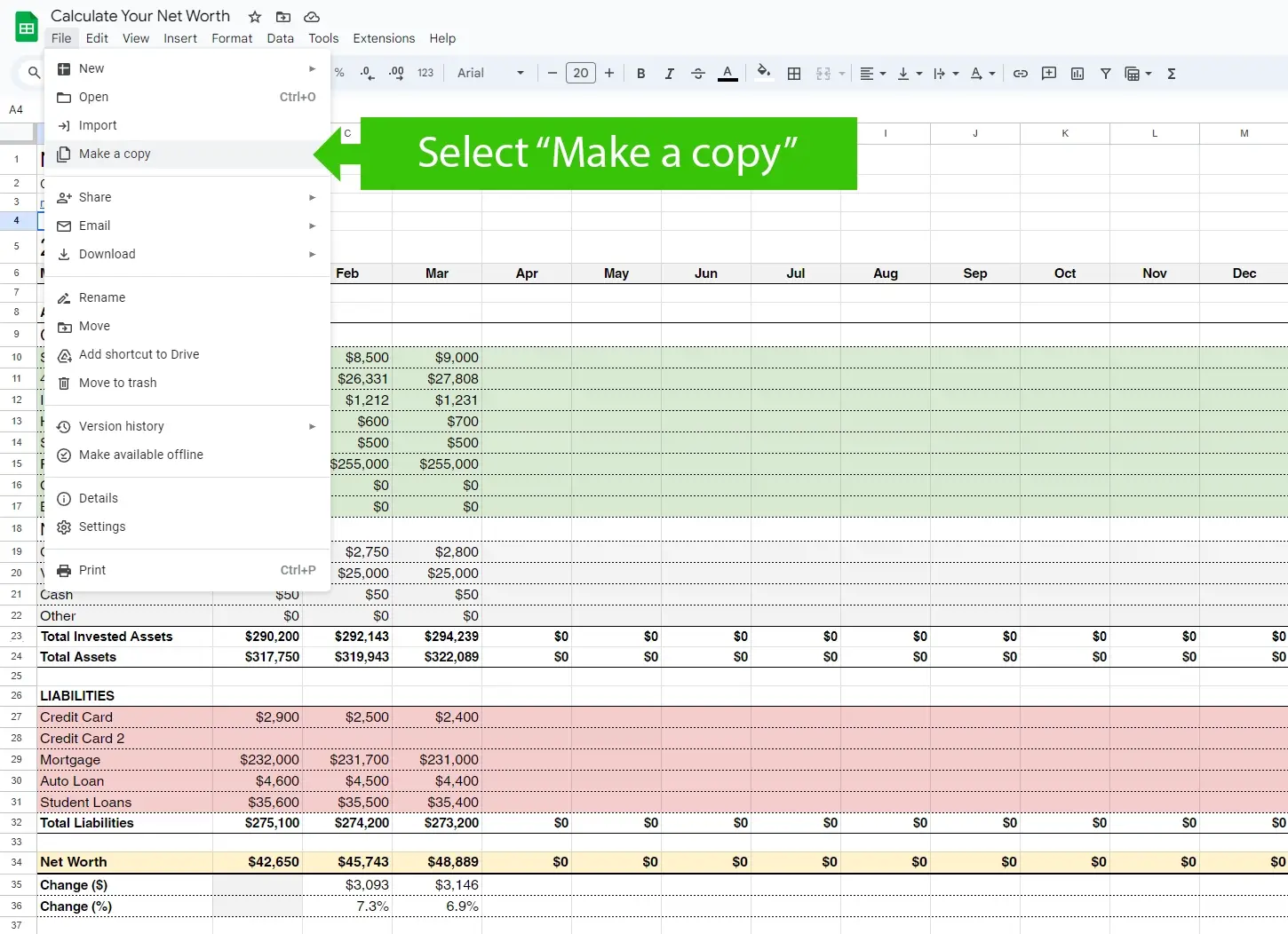

- Quick options: Jot it down on paper, use a simple Excel/Google Sheet, or an online net worth calculator. (We’ve included a free Google Sheet template from Net Worth Insights to make this easy – more on that soon!)

Pro Tip: Save a copy of this initial calculation. This is like a “before” photo in a fitness journey. You’ll want to look back at it later to see how far you’ve come.

Choose a Tracking Method That Works for You

There are a few popular ways to track net worth – pick one that you’ll stick with:

- Spreadsheet (Manual) – Perfect if you like full control. You can use Excel or Google Sheets. You’ll enter account balances and values yourself. It’s simple and customizable (you can add whatever categories or notes you want). Many find the act of entering numbers manually makes them more connected with their money. We’ve got a free Net Worth Insights Google Sheet that’s beginner-friendly and already set up with the formulas – just plug in your numbers each time.

- Automated Apps/Platforms – These connect to your bank and investment accounts and update your net worth automatically. They’re convenient (no manual data entry after the initial setup) and often come with charts and analytics. Examples include Empower (formerly Personal Capital) – a free dashboard that aggregates all accounts, or Mint (a popular free budgeting app that also tracks net worth) – though note Mint’s future is evolving as it merges into other Intuit offerings. Other paid options like Kubera or Monarch Money offer sleek interfaces and can handle even complex asset types (crypto, real estate estimates, etc.).

- Hybrid (Spreadsheet + Feeds) – If you want the best of both, tools like Tiller Money provide automated bank feeds into Google Sheets. This means your spreadsheet updates with your latest balances every day, but you still have the flexibility of a spreadsheet format. It’s a great solution for those who love spreadsheets but not manual data entry. (Tiller offers a 30-day free trial, then about $79/year.)

- Decision factor: If you enjoy tech and want real-time updates, an app might be best. If you prefer a hands-on approach and customization, go with a spreadsheet. There’s no wrong choice – the best method is the one you’ll actually use consistently.

Set a Schedule (Consistency is Key)

Decide how often you’ll update and review your net worth. Common frequencies are monthly or quarterly. Monthly is great to stay very tuned-in (and is typical if you’re in a growth or debt-payoff phase and want to see progress each month). Quarterly is fine if your finances are on autopilot and you just want periodic check-ins. Mark it on your calendar or set a reminder. Example: “Net worth review on the 1st of every month.” It can even become something you look forward to – a little ritual of seeing where you stand.

- Avoid tracking too often (like daily or weekly) – investments can swing and bills come at different times, which can make ultra-frequent tracking misleading and stressful. Give enough time for meaningful change between check-ins.

- When you update, record the date and the net worth figure. Over time, you’ll compile a log of data points that you can graph or analyze to truly see your trajectory.

Use Categories and Notes

As you track, it helps to break your net worth into categories. For assets, you might separate “Retirement Accounts,” “Real Estate,” “Cash Savings,” “Investments,” “Personal Property.” For liabilities: “Mortgage,” “Student Loans,” “Credit Cards,” etc. This way, you not only see the total, but also how each part changes. Maybe your investments grew but you bought a car (adding a liability), so one went up and one went down. Noting those changes helps explain why your net worth moved.

- Most apps will automatically categorize by account type, and if you use a spreadsheet, consider creating sections for each category. Our Net Worth Insights template, for example, has predefined sections for common asset and debt categories, which you can customize.

- Add notes for context: Jot a one-liner when something significant happens – “Got a bonus, added to savings,” “Market drop this month, investments down,” “Paid off car loan!” These notes will be gold when you look back. They turn your net worth history into a story of your life events and decisions.

- Avoid tracking too often (like daily or weekly) – investments can swing and bills come at different times, which can make ultra-frequent tracking misleading and stressful. Give enough time for meaningful change between check-ins.

- When you update, record the date and the net worth figure. Over time, you’ll compile a log of data points that you can graph or analyze to truly see your trajectory.

Analyze and Adjust

Every so often (perhaps once a year), take a deeper dive. Look at your net worth trend line. Are you happy with the direction and speed? If yes, great – keep doing what you’re doing. If not, this analysis can spotlight areas to improve:

- Identify Bottlenecks: Maybe your net worth isn’t growing because debt is dragging it down (interest piling up), or maybe you’re sitting on too much cash that’s not invested. Identifying these factors can lead to action (like refinancing expensive debt, or moving cash into investments for growth).

- Revisit Goals: Use your tracking to see if you’re on pace for the goals you set. If you aimed to increase net worth by $10K this year and you’re only up $5K mid-year, you might decide to boost your savings rate or cut an expense to catch up. On the other hand, if you surpassed your goal early, perhaps set a new stretch goal!

- Life Events: Adjust for any life changes. If you get married and merge finances, you’ll have a joint net worth to track. If you buy a house, your asset and liability mix changes – ensure you’re including new entries (house value, mortgage). The tracking process is flexible; update your method as your life evolves (our template allows adding/removing line items easily, and apps will update when you link new accounts).

Stay Motivated – Use Tools & Communities

To avoid “tracking fatigue,” leverage tools that make it fun. Many apps display your net worth in pretty charts or even celebrate milestones (Empower, for example, has graphs that show your progress and can project future net worth). You can also engage with personal finance communities – lots of people share their net worth journeys on blogs or forums, and cheering each other on can be motivating. Consider joining a subreddit or community challenge where you post updates (anonymously if you prefer) to keep yourself accountable.

- Gamify it: Some people set up mini-challenges, like a Net Worth Challenge to increase it by a certain amount in a timeframe, or to hit a net worth equal to a year’s salary by a certain age. These little games, when tracked, can spur you to find creative ways to win (like finding an extra $100 to invest or selling unused items to reduce clutter and boost savings).

Recommendations

You can track your net worth for free with our free Google spreadsheet. If you are looking for a more automated way to track your net worth, then we recommend downloading Rocket Money for your phone. Rocket Money Premium is the cheapest net worth solution at only 36 dollars a year. (As of July 2024)

Conclusion: Track Your Net Worth Today – Your Future Self Will Thank You

By now, you should see that tracking your net worth is more than an academic exercise – it’s a foundational habit for building wealth and achieving financial security. It gives you clarity about where you stand, motivation to improve, and data to make informed decisions. It bridges the gap between where you are and where you want to be financially. Both beginners and experts benefit: if you’re just starting, it’s your map and compass; if you’re already money-savvy, it’s your dashboard for fine-tuning the journey.

The best part? It’s never too late or too early to start. Whether you’re 20 and beginning your career or 50 and planning retirement, knowing your net worth and watching it evolve can only help you. It’s okay if the number isn’t pretty today – think of it as your baseline. Remember how we discussed that first “weigh-in”? The only direction to go from here is up, as long as you commit to paying attention and taking action.

Call to Action: Make a promise to yourself to calculate your net worth today. It might take 30 minutes that could change the trajectory of your finances. Use the tools and tips we’ve outlined: maybe download our free Net Worth Insights Sheet as a starting point, or sign up for one of the apps. Set a calendar reminder for next month’s check-in. This small habit, repeated over time, will yield massive results. You’ll start to see opportunities to save more, invest wisely, or cut down debt – because that net worth number will nudge you in the right direction.

Imagine one year from now, having twelve months of net worth data under your belt. You’ll be able to proudly say, “My net worth grew by X% this year,” and more importantly, you’ll know exactly why – because you tracked it and steered it. That sense of control and progress is incredibly empowering. It’s the kind of momentum that can carry you to big life goals: buying that home, starting that business, retiring with peace of mind, you name it.

So take that first step. Track your net worth – no matter how humble the beginning – and watch how this simple act can transform your financial journey. Your future self is already cheering you on, grateful that you started today. Let’s build that wealth, one entry at a time!