The concept of an employee match in retirement savings plans like 401(k)s is a game-changer. It’s a benefit offered by many employers, yet its true value often goes underappreciated. Let’s cut to the chase and uncover why the employee match is unmatched in building your financial future.

What is an Employee Match?

An employee match is a contribution made by your employer to your retirement savings plan, usually a 401(k), based on the amount you contribute from your salary. For example, an employer might offer a 50% match up to 6% of your salary. This means if you contribute 6% of your salary, your employer will add an additional 3%.

The Power of Free Money

Let’s get straight to the point: the employee match is free money. Every dollar your employer adds to your retirement savings is a dollar you didn’t have to earn. This is money that grows your nest egg without any extra effort on your part. It’s a simple, effective way to boost your retirement savings, and passing it up is akin to refusing a bonus or a raise.

Compounding Growth

The magic of compounding can’t be overstated. When you invest, you earn returns on your initial investment and on the returns that the investment has already generated. By leveraging the employee match, you increase the principal amount in your retirement account, leading to even more significant growth over time.

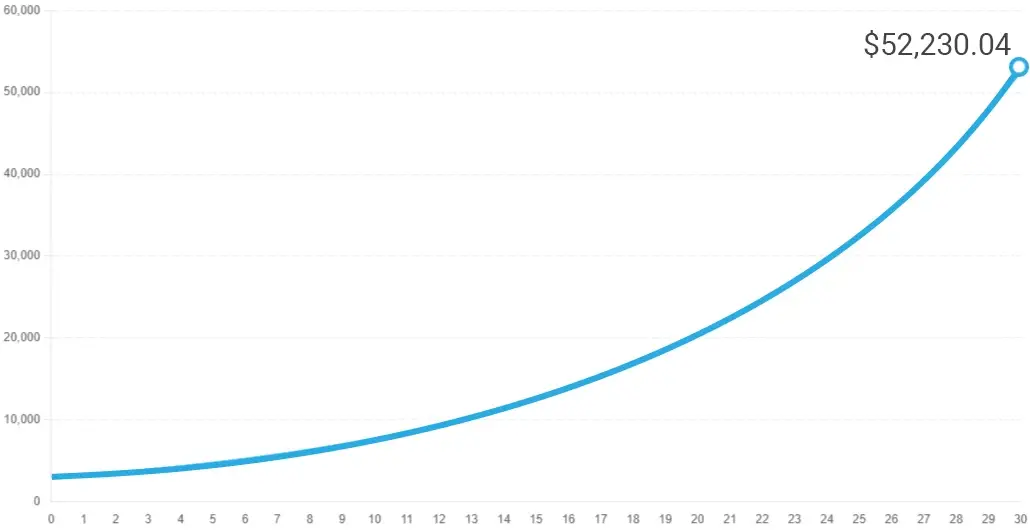

Imagine this You invest $1,500, and with the employer match, you get an extra $1500 if you earn a 10% annual return in 30 years. The total investment after 30 years is approximately $52,230.04, which is $26,174 more than you would have without the match. The employee match amplifies your retirement savings exponentially.

Immediate Return on Investment

Think of the employee match as an immediate 100% return on investment (ROI) if your employer matches dollar for dollar. Even with a lower match percentage, the ROI remains incredibly high compared to other investment opportunities. It’s a guaranteed return you won’t find elsewhere.

Tax Advantages

Contributions to your 401(k), including the employer match, often come with tax advantages. Pre-tax contributions reduce your taxable income, allowing you to defer taxes until you withdraw the money in retirement. This tax deferral can result in significant savings over time, giving your investments more room to grow.

Boosting Financial Security

Financial security in retirement is a top concern for many. By taking full advantage of the employee match, you ensure you’re maximizing your retirement savings potential. This can lead to a more comfortable, financially secure retirement, reducing the stress and uncertainty that many face in their later years.

The Bottom Line: Don’t Leave Money on the Table

If you’re not taking full advantage of your employer’s 401(k) match, you’re essentially leaving free money on the table. It’s an unmatched benefit that can significantly impact your financial future. Review your retirement plan, increase your contributions to maximize the match, and watch your retirement savings grow.

In the world of personal finance, the employee match stands out as a powerful tool for building wealth. Make sure you’re leveraging this unmatched opportunity to its fullest. Your future self will thank you.