Ever notice how two people with the same salary can end up living wildly different retirements? It’s rarely about luck or raises—it’s about who let their dollars start compounding first.

Story Time

Meet Ava and Ben, both hired at 23 on identical $55k salaries. Ava sets up an automatic transfer of $150 into a low-fee index fund every payday. Ben means to, but spends a few years “waiting until things settle down.” Fast-forward: at 35 Ava pauses contributions to focus on a down-payment goal, while Ben finally starts investing the same $150.

“No Benegimans” Ben

Ben, hired the same day and earning the same salary, promises himself he’ll “start investing once things settle.” He finally switches on the same $150/month contribution at 35—just as Ava stops—and keeps it running all the way to 65.

Total Invested: $54,000

Ben at 65: ≈ $340,000

Ava “The Sava”

Ava, 23, automates $150 a month into a low-cost index fund averaging 10% a year (roughly the long-term S&P 500 return). She keeps that habit for 12 years, then stops at age 35 to redirect cash toward a home purchase. Her existing nest egg keeps compounding on autopilot.

Total Invested: $21,600

Ava at 65: ≈ $720,000

Same job, same contribution amount—Ava just gave her money more time to snowball, so every earlier dollar kept recruiting new dollars, which then recruited more.

Plain-English Breakdown:

Compound interest is money that pays you in layers:

First layer: You earn on the cash you contribute.

Second layer: Your earnings start earning too.

Every layer after: Growth feeds on the growth before it, so the curve steepens with time.

That’s why delaying a few years forces you to contribute 2-3× more just to match an early starter’s finish line. The math isn’t fancy; the clock is just more powerful than any budget hack or side hustle.

Takeaway: The easiest raise you’ll ever give yourself is the one you schedule today. Automate a deposit you won’t miss, keep fees microscopic, and let time drive the compounding engine. Every check you invest now is future work you—and your kids—won’t have to do later.

The Core Principle – How Your Dollars Multiply Themselves

1.1 Simple vs. Compound: The 8th-Grade Math That Changes Everything

Simple interest is a flat tip: you earn the same dollars every year on your original deposit. Put $1,000 in a 5 % simple-interest account and you pocket $50 a year—forever.

Compound interest is a snowball: you earn on the principal plus every dollar it already earned. That same $1,000 at 5 % compound interest turns into $1,628 after 10 years, $2,653 after 20, and so on. The gap widens because last year’s interest is now earning its own interest.

1.2 The Math in Plain English

The growth formula is principal × (1 + rate)^years. Ignore the syntax; focus on the lever: the exponent (“years”) makes returns stack on themselves. Every extra year you give the equation is fuel on the fire.

Quick check: At 10 %, money doubles roughly every 7.2 years (Rule of 72: 72 ÷ 10 = 7.2). That’s why Ava’s early-start dollars lapped Ben’s late-start dollars without any extra effort.

1.3 See the Snowball

Visualize two lines on a graph starting at $1,000:

Simple line climbs in a straight, polite slope.

Compound line hugs the simple one at first, then bends upward like a ski jump. That curve is the compounding curve, and it gets steeper the longer it runs.

Key takeaway: Compound interest is less about the rate and more about the runway. Give your dollars decades—then let the math take the wheel.

Action Step: Open any online compound-interest calculator and plug in $100 a month, 8 % return, 30 years. Watch the final number, then add just 5 more years. The extra time alone usually adds six figures—proof that the clock is your biggest asset.

Time Is the Multiplier — Why Waiting Costs More Than You Think

2.1 The “Procrastination Tax” in Real Dollars

Money doubles roughly every 7 years at 10 % (Rule of 72). Skip just one doubling cycle and you chop your future balance in half.

Small contributions scale with decades, not pay-raises. Add $150 a month at 25 and you give those dollars 40 years of compounding; start at 35 and you surrender an entire doubling.

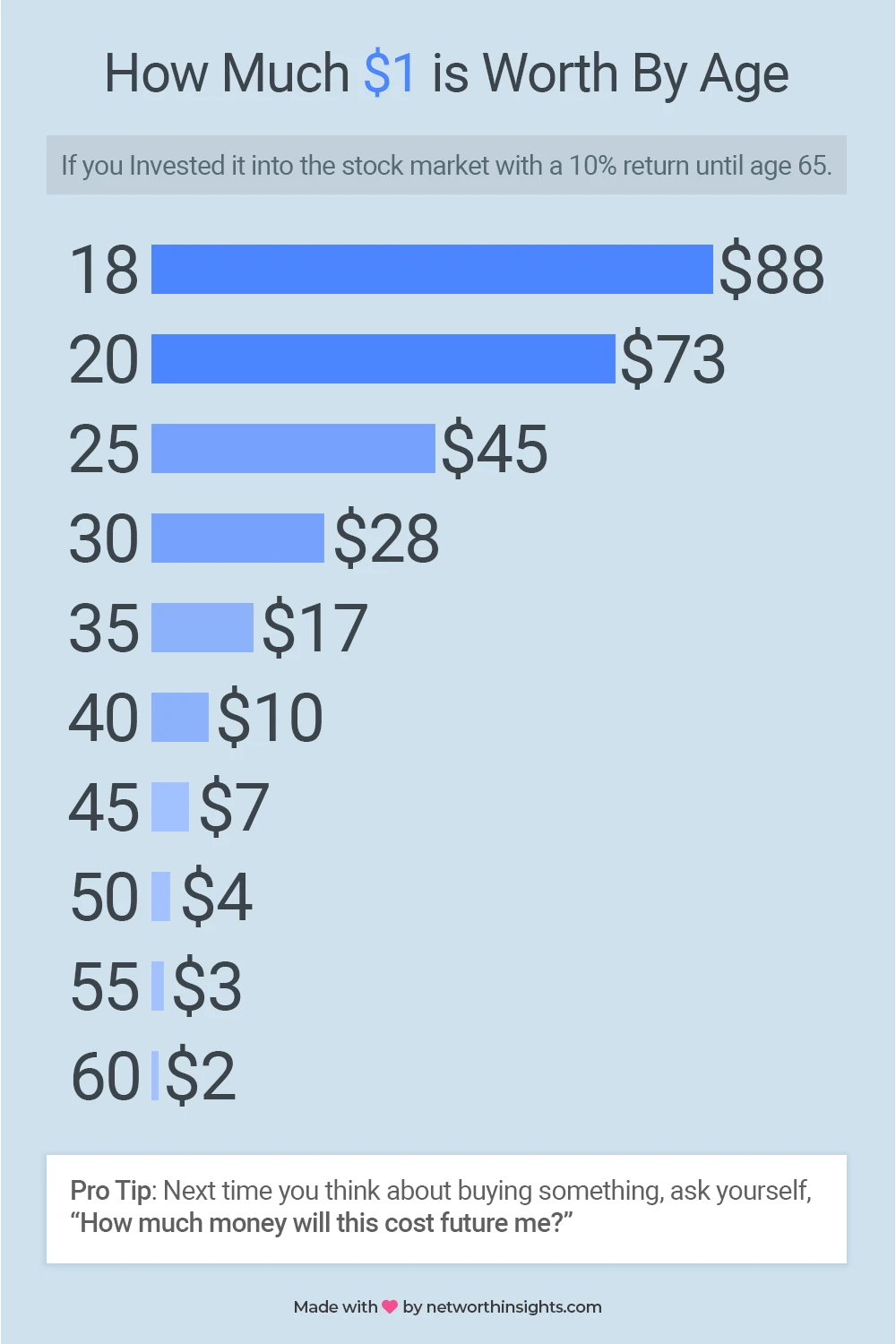

This infographic, which I created a while back, sums it up perfectly, but if you still need more. Check out our calculator to figure out how much a dollar is worth to you. Find it here

2.2 Ava vs. Ben, Revisited

Ava invests $150 / mo from 23 – 35, then stops. Her 12 years of contributions snowball to ≈ $720 k by 65.

Ben waits and contributes the same $150 / mo from 35 – 65. After 30 years he finishes with ≈ $340 k.

Result: Ava pays $21.6 k out-of-pocket and laps Ben, who pays $54 k. Time—not effort—created the extra $380 k.

2.3 Turn Years Into Freedom, Not Stress

Automate now, tweak later. Even $50 a month started today beats $200 started five years from now.

Schedule a yearly “raise.” When you get a salary bump, bump your automatic transfer first, lifestyle second.

Track your runway. Use any basic compound-interest calculator to map the year your passive growth overtakes your living costs—your personal freedom date. Watching that gap close is addictive motivation.

Key takeaway: Compound interest isn’t just a higher yield; it’s a time amplifier. The sooner you press “play,” the harder the math works and the less you’ll have to later. Start the clock today.

Rate of Return — Small Tweaks, Huge Outcomes

3.1 A “Tiny” 1 % Feels Tiny…Until You Run the Math

Even with the same $150 monthly contribution for 30 years, your ending balance swings six figures when the average return shifts by only a single percentage point:

Average Annual Return | Value After 30 Years | Extra vs. 7% |

5% (high‑yield savings) | $125k | -$58k |

7% (conservative stock mix) | $183k | $0 |

8% (broad‑market index) | $224k | +$41k |

10% (long‑term S&P 500 avg.) | $339k | +$156k |

*Assumes monthly contributions, dividends reinvested, no additional fees or taxes.

That single-percentage bump from 7 % → 8 % delivers an extra $41,000—money created purely by picking a slightly better vehicle (or cutting a 1 % fee).

3.2 Where to Find (and Keep) the Extra Percent

Low-Cost Index Funds (Core Holding)

Expense ratios ~0.03 % vs. 1 % in many active funds.

Historically track 8 – 10 % before fees.

Tax-Advantaged Buckets

401(k), IRA, HSA shelter gains from Uncle Sam so more of every percent compounds.

Dollar-Cost Averaging

Consistent buys smooth out volatility, letting more shares ride the next upswing.

Employer Match = Instant Return

A 50 % match on your first 6 % contribution is a risk-free 50 % gain before markets even move.

3.3 Slash the Drag: Fees, Taxes & Inflation

Expense Ratios: A 1 % fund fee in a 7 % market means you’re really earning 6 %—cutting your 30-year balance by roughly 25 %.

Advisory Fees: A 1 % AUM charge stacks on top of fund costs. Opt for flat-fee or robo advisors capped under 0.35 % where possible.

Turnover Taxes: High trading activity triggers capital-gains taxes; broad index funds keep turnover minimal.

Inflation: Aim for returns that outpace the CPI by at least 3–4 % to ensure real growth.

Quick Action Checklist

- ✅ Audit Your Fund Fees tonight—anything above 0.20 % deserves a second look.

- ✅ Grab Every Match in your 401(k)—it’s a guaranteed return.

- ✅ Automate into a Broad Index (VTI, FXAIX, etc.) every payday; review allocation once a year.

Bottom line: After time, rate of return is the biggest lever you control. Trim costs, boost efficiency, and each extra percentage point you capture today stacks into tens—or hundreds—of thousands by the time you’re ready to cash in.

Contribution Frequency & Consistency — Turning Sporadic Cash Into a Relentless Growth Machine

4.1 Why “When” You Deposit Beats “How Much You Stress About Timing”

Bi-weekly vs. Monthly: If your broker credits interest daily (most do), the math gain from splitting $300/month into two $150 checks is tiny—think coffee-money over decades.

The Real Edge: More events mean more chances to invest every pay-day before the cash drifts into spending. Consistency trumps perfect market timing every single time.

Rule of Thumb: Match your deposit cadence to your paycheck. Paid every two weeks? Invest every two weeks. Paid irregularly (gig work)? Automate a percent of each deposit instead of a fixed dollar amount.

4.2 “Set-and-Forget” Blueprint (Ally → Wealthfront Example)

Create Two Buckets

Bucket 1 – Spending Hub: Ally Checking for bills & swipe purchases.

Bucket 2 – Growth Engine: Wealthfront (or similar) taxable brokerage or IRA.

Automate Transfers

Every Pay-Day: Ally auto-sends 15 % of your net pay to Wealthfront; Wealthfront auto-buys a low-cost total-market ETF.

Annual Raise Bump: Schedule Ally to nudge the transfer up by 1 – 2 percentage points on the same day your raise hits.

One-Minute Quarterly Check-up

Glance at contribution history → confirm transfers ran.

Rebalance only if you’ve drifted > 5 percentage points from target allocation.

Result: You remove willpower from the equation. Consistency becomes default, not discipline.

4.3 Plug the “Found-Money Leak”

- Bonuses & Tax Refunds: Before the cash settles in your checking account, funnel at least 50 % straight to the brokerage.

- Cash-Back & Rewards: Many cards let you autopay rewards into an investment account—tiny snowflakes that turn into real powder over 20–30 years.

- Debt-Payoff Rollovers: Finished a car loan? Redirect the retired payment to your compounding engine immediately so lifestyle creep can’t claim it.

Key Takeaway: The market rewards time in the game and units invested—both explode when deposits happen automatically and often. Nail the cadence now; watch the habit quietly multiply everything else you’ve read in this guide.

Hidden Enemies That Erode Your Compounding

5.1 Inflation — The Silent Pickpocket

What it does

Inflation quietly slices buying power; 3 % annual inflation cuts today’s dollar to about 55 ¢ in 20 years.

Your defense

- Aim for “real” returns (investment return – inflation). A portfolio earning 10 % in a 3 % inflation world is really compounding at 7 %.

- Keep idle cash minimal. Anything above a 3–6-month emergency fund should be invested, not lounging in a 0 % checking account.

- Add inflation hedges (broad-market equities, TIPS, or I-Bonds) once your core index position is set.

5.2 Fees — Tiny Percentages, Massive Drag

Same market, same contributions—only the fee changes.

Cut the drag

Expense ratio ≤ 0.10 % for core holdings (VTI, FXAIX, ITOT, etc.).

Avoid “advisory AUM” fees above 0.40 %; negotiate fixed or hourly if you truly need a planner.

Check your 401(k) line-up: if the lowest-cost option is a 0.75 % target-date fund, lobby HR or use the match then roll over to an IRA each year.

5.3 Lifestyle Creep — The Quiet Compounding Killer

Problem

- Every raise that inflates spending instead of investments steals future growth.

Fix

- “50 % Rule” — automatically divert half of every raise or bonus into your investment transfer.

- Track net-worth, not net-income. Watching the wealth graph climb scratches the same dopamine itch as spending.

- Set pain-free guardrails: keep housing ≤ 30 % of take-home and vehicles ≤ 15 %. Everything else flexes around your compounding goal.

Quick Anti-Erosion Checklist

- ✅ Switch any fund with fees > 0.25 % to a low-cost index alternative this week.

- ✅ Route the next bonus/refund straight to your brokerage before it hits checking.

- ✅ Schedule an annual “inflation audit” to bump contributions if CPI jumps.

Key Takeaway: Compounding grows in silence, but so do its enemies. Knock out inflation drag, fee friction, and lifestyle creep early and the math will keep building wealth long after you stop thinking about it.

Action Plan — Flip the “Compound Switch” in 30 Minutes

Step-by-Step Checklist

Open or Log In to Your Brokerage (5 min)

Prefer: Vanguard, Fidelity, Schwab, or Wealthfront.

Confirm you can buy low-cost index ETFs (expense ratio ≤ 0.05 %).

Automate the Contribution (7 min)

Amount: Minimum 10 – 15 % of take-home; start smaller if cash-tight.

Cadence: Match your paycheck (bi-weekly, monthly, gig-based %).

Destination: Core holding like VTI, ITOT, or FXAIX.

Grab Free Money (3 min)

Check your 401(k) or SIMPLE IRA match settings — max it out.

Redirect cash-back credit-card rewards straight to the same brokerage.

Cut Fee Drag (5 min)

Scan current funds; anything over 0.25 % → swap to an index equivalent.

Opt out of advisory “wrap” fees unless service < 0.40 % and value is clear.

Schedule a 15-Minute Annual Review (2 min)

Calendar invite every January 2nd: “Rebalance & bump auto-transfer by 1 – 2 pp.”

Treat it like an important appointment — non-negotiable.

Track the Snowball (3 min)

Add accounts to a tracker (Rocket Money, Tiller, or a simple spreadsheet).

Log net-worth monthly; watch the curve steepen for built-in motivation.

Pro Tip: Funnel at least 50% of every raise, bonus, extra paycheck, or tax refund into the same automated pipeline before it hits checking. Lifestyle never notices; the future you gets paid.

Create a Statement of Commitment (Copy-Paste):

“I invest first, spend second. Every automated deposit buys me time, freedom, and options.”

Sign it, pin it near your screen, or somewhere you will see it often, and let time do your heavy lifting.

Conclusion — Compounding Is Non-Negotiable

Compound interest isn’t a “nice-to-have”; it’s the force multiplier that separates comfortable retirements from financial scramble. Ava and Ben proved the math: the person who starts early—even if they stop contributing later—can crush someone who invests longer but starts late.

The good news? You don’t need special talent, a six-figure salary, or Wall Street secrets. You only need three things you already control:

Time: Start today—even with $25—so the clock works for you, not against you.

Consistency: Automate deposits and let your money grow on autopilot.

Efficiency: Keep fees microscopic and returns tax-advantaged so every extra percent compounds into real dollars.

Flip that “compound switch” now. Open your brokerage tab, schedule the transfer, and watch the invisible snowball begin to roll. Your future self won’t remember the skipped latte—but they’ll never forget the freedom a well-fed compounding engine delivers.

Next step: Plug your numbers into our free Compound Growth Calculator at NetWorthInsights.com. Set your first automated deposit before you close this browser window—and let time do the rest.