Whether Einstein actually said this or not doesn’t matter—because the statement is absolutely true.

If you’re a young professional and you don’t understand compound interest, you’re leaving money on the table. This isn’t some Wall Street trick or advanced financial concept reserved for the rich. It’s the most powerful force in personal finance, and it works for you if you let it.

In this post, I’m going to show you exactly what compound interest is, why it’s a game-changer, how the wealthy have used it to get ahead, and—most importantly—how you can start using it today.

What Is Compound Interest (And Why Should You Care)?

Let’s get simple.

Compound interest is when you earn interest on your initial money and on the interest it already earned.

In other words, your money earns money. Then that money earns more money. It snowballs. That’s why it’s so powerful.

Now compare that to simple interest, which only pays you based on the original amount you put in. It doesn’t stack. It doesn’t snowball. It’s boring—and slow.

Example:

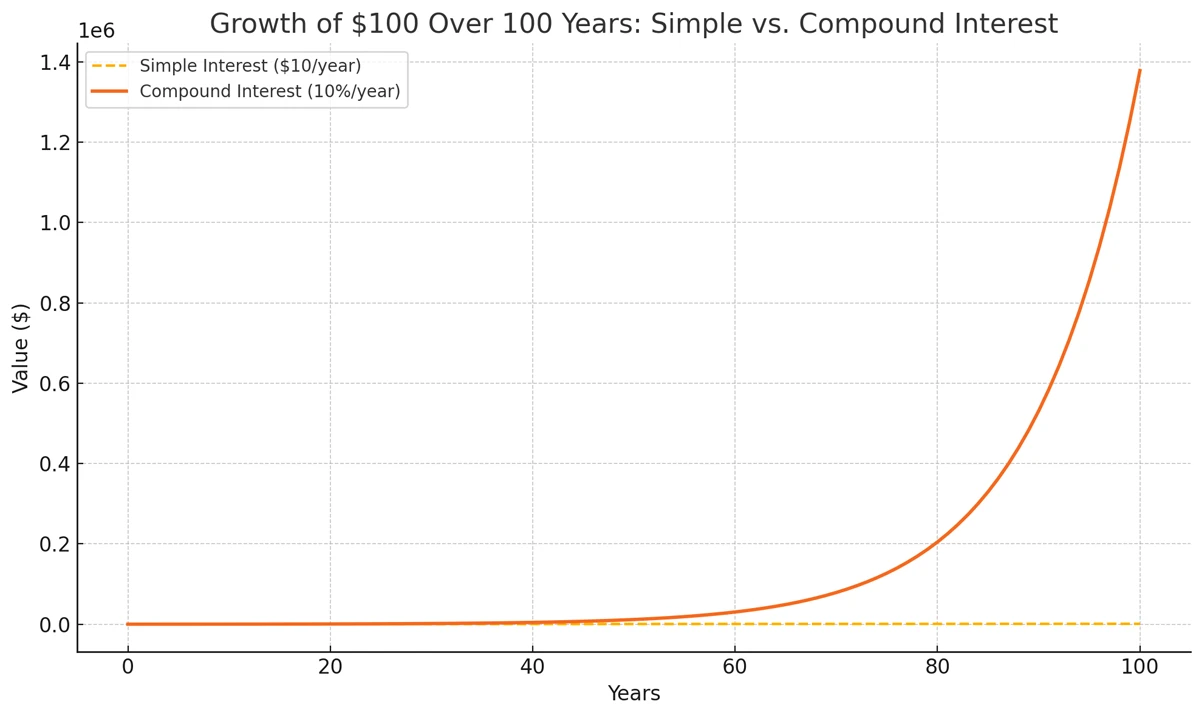

You invest $100 at 10% interest.

- Simple Interest: After 100 years, you have $1,000 in interest. That’s $10 per year.

- Compound Interest: After 100 years, you earn $1,377,961 because the interest you earn each year also earns interest. In the first year, you earn $10.14, but in the last year, you end up earning $125,278.29 in the same one-year time span.

This over-exaggerated example showcases the true power of compound interest. You can see just how much of a gap there can be over a long period of time.

The Snowball Effect: Why Time Is Your Biggest Asset

Compound interest rewards time in the game. The longer you stay invested, the more your money accelerates.

It’s like rolling a snowball down a hill. At first, it barely grows. Then it gains size, momentum, and speed—until it’s a massive force that can’t be stopped.

Warren Buffett didn’t become a billionaire because he picked the best stocks. He became a billionaire because he started investing at age 11 and never stopped. In fact, 99% of his wealth came after his 50th birthday.

Let that sink in.

Real-World Proof That Compound Interest Works

Theory is nice. But let’s talk about real people who built serious wealth using nothing but patience, consistency, and the magic of compounding. These aren’t trust fund babies or crypto lottery winners—just ordinary individuals who understood the game.

Ronald Read – The Janitor Who Died a Millionaire

Ronald Read was a janitor and gas station attendant in Vermont. He never made more than an average living, wore old flannel shirts, and drove a used car. Most people assumed he was just getting by.

But when he passed away in 2014 at the age of 92, he shocked everyone by leaving behind a $8 million fortune.

How?

He lived below his means, saved regularly, and quietly invested in blue-chip dividend-paying stocks. He held them for decades, reinvested every dividend, and let compound interest do its thing.

His secret wasn’t timing the market. It wasn’t high income. It was time + consistency + patience. He turned ordinary income into extraordinary wealth simply by understanding compounding and playing the long game.

Lesson: You don’t need to earn more—you need to give your money more time to work.

Benjamin Franklin – 200-Year Financial Experiment

Back in 1790, Ben Franklin left $4,000 in trust to the cities of Boston and Philadelphia, with a catch: the money had to be invested and allowed to compound for 200 years.

Fast forward two centuries.

Boston’s fund grew to over $4.5 million. Philadelphia’s fund hit $2 million, even after pulling money out along the way for public projects.

That’s a return of over 1,000x—not because of high-risk investing, but because the money was allowed to grow untouched for generations.

Franklin’s experiment proved one thing: time can turn modest amounts of money into fortunes. No fancy strategies. Just compound interest and a long runway.

Lesson: Small money + long time = big results. The earlier you start, the more outrageous the outcome.

Grace Groner – The Secretary Who Left Millions to Charity

Grace Groner worked as a secretary for 43 years at Abbott Laboratories. She lived in a one-bedroom house, wore secondhand clothes, and never drew attention to herself.

In 1935, she bought $180 worth of Abbott stock. She held it. Reinvested dividends. Never sold. Over time, that modest investment grew to over $7 million by the time she passed away in 2010.

She didn’t blow it on herself. She left it all to a scholarship fund for students—impacting generations to come.

Again: not a high income. No trading, no risky bets. Just a long-term mindset, smart investing, and compound growth.

Lesson: It’s not about how much you invest—it’s about how long you let it grow.

Where Can You Earn Compound Interest?

You don’t need to be a genius or millionaire to use this. There are simple places you can start right now:

💰 High-Yield Savings Accounts & CDs

- Safe and predictable.

- Interest compounds monthly.

- Great for emergency funds or short-term goals.

- Example: Ally, SoFi, Capital One—all offering 4–5%+ APY.

📈 The Stock Market (Index Funds & Dividend Stocks)

- S&P 500 averages 8–10% annually over the long term.

- Reinvest your dividends.

- Use low-cost ETFs like VOO, SPY, or FXAIX.

- More risk, more reward—but the compounding here is explosive.

🏠 Real Estate

- Rental income + property appreciation.

- Use cash flow to pay down the mortgage or buy more properties.

- You can even invest in REITs if you want hands-off real estate.

🔒 Retirement Accounts (401(k), Roth IRA)

- No taxes while your money compounds (or tax-free with Roth).

- Employer match = free money.

- Compound growth with serious tax advantages.

Compound Interest in Action

The Doubling Penny – Would You Take $2 Million or a Penny?

Let’s play a game.

I offer you two choices:

- Take $2 million in cash today.

- Or take one penny, but it doubles in value every day for 30 days.

Most people grab the $2 million and never look back.

But here’s what happens with the penny:

- Day 1: $0.01

- Day 10: $5.12

- Day 20: $5,242.88

- Day 25: $167,772.16

- Day 28: $1.34 million

- Day 30: $5,368,709.12

That 1¢ turns into over $5.3 million in just 30 days—more than double the $2 million you thought was the better deal.

But here’s what’s wild:

- On Day 15, you only have $163.84

- Even by Day 20, you’re just crossing $5,000

The real power shows up in the final 5 days. That’s when compound growth goes from “slow and steady” to “explosive.”

Lesson: Compounding feels slow at first. But it rewards the patient and punishes the impatient. Just like in investing, the big wins come to those who stick around long enough for the curve to turn vertical.

Jack vs. Jill – The Cost of Waiting

Let’s look at two fictional characters modeled from real-world scenarios. Both earn a 10% average annual return in the stock market.

Jack Invests $200 a month for 30 years, and Jill invests $200 dollars a month for 10 years.

Jill ends up with almost 3 times more than Jack in retirement. How is this Possible? Jill must have been inside trading, right!? She invested less money and stopped decades earlier, but she ended up with more. Why?

Because her money had an extra 10 years to compound. This is why in time in the market is always an advantage.

Jack’s – Better Late Than Never Strategy

He waits until age 35 to start. He invests $200/month for 30 years (ages 35–65). Total invested = $72,000.

At Age 65:

Jack has $440,000

Jill – Invest Early Strategy

She starts investing at age 25. She puts in $200/month for just 10 years (ages 25–35), then stops. Total invested = $24,000.

At Age 65:

Jill has $1.3 million

Lesson: Time beats money. The earlier you start, the less you have to invest—and the more you’ll likely end up with an easy life in retirement.

How to Make Compound Interest Work for You

Let’s get tactical. Here’s how you turn this knowledge into wealth:

✅ Start Now

The earlier you start, the bigger the impact. Waiting just 5 years can cost you hundreds of thousands in lost gains. Time is your greatest weapon—use it.

✅ Automate Everything

Set up recurring contributions to your Roth IRA, 401(k), or brokerage account. Make it automatic, so you don’t rely on willpower.

✅ Reinvest Your Earnings

Turn on dividend reinvestment. Let every dollar keep working for you. Don’t spend your interest—grow it.

✅ Don’t Touch It

Withdrawals kill compounding. Let your money sit and do its thing. The more uninterrupted it is, the faster it grows.

✅ Cut Fees

High fees slow compounding. Choose low-cost index funds and avoid actively managed funds with expense ratios above 1%.

The Biggest Mistakes People Make

- Waiting too long to start.

- Not reinvesting dividends.

- Cashing out early.

- Keeping too much in low-yield accounts.

- Ignoring employer 401(k) match (aka free money).

Avoid these traps, and you’ll be way ahead of the curve.

Final Thoughts: Build Your Future on This

Here’s the truth most people never realize:

You don’t need a six-figure salary.

You don’t need a finance degree.

You don’t need to time the market.

You just need to start early, stay consistent, and let time do its thing.

Compound interest is the ultimate cheat code for wealth. It makes your money work harder than you do. And once it gains momentum, it’s nearly unstoppable.

If you’re in your 20s or 30s, this is your golden window. Use it. Your future self will be blown away by what you built.

Set up your first automatic investment today. Doesn’t matter if it’s $50 or $500—just start the snowball.