What Are Taxes?

Taxes are money that people pay to the government. The government uses tax money to pay for things we all use, like roads, schools, hospitals, and parks. There are different types of taxes, and each one has a specific purpose. Let’s talk about some of the main types:

- Income Tax: This is money taken from the income you earn from your job, investments, or business.

- Sales Tax: This is a small amount added to the price of items you buy, like groceries or clothes.

- Property Tax: This is money paid by people who own property, like houses or land.

What People Often Think: “If I Earn More, I Lose Money to Taxes”

One common misunderstanding is that earning more money puts you in a higher tax bracket and means you’ll end up with less money. But this isn’t true! Let’s say you get a raise at work. The extra money you make is taxed at a higher rate, but the rest of your income is still taxed at a lower rate. So, you still take home more money overall.

How Income Taxes Actually Work

Income tax is one of the most common types of taxes, and it’s based on how much money you make. Here’s how it works:

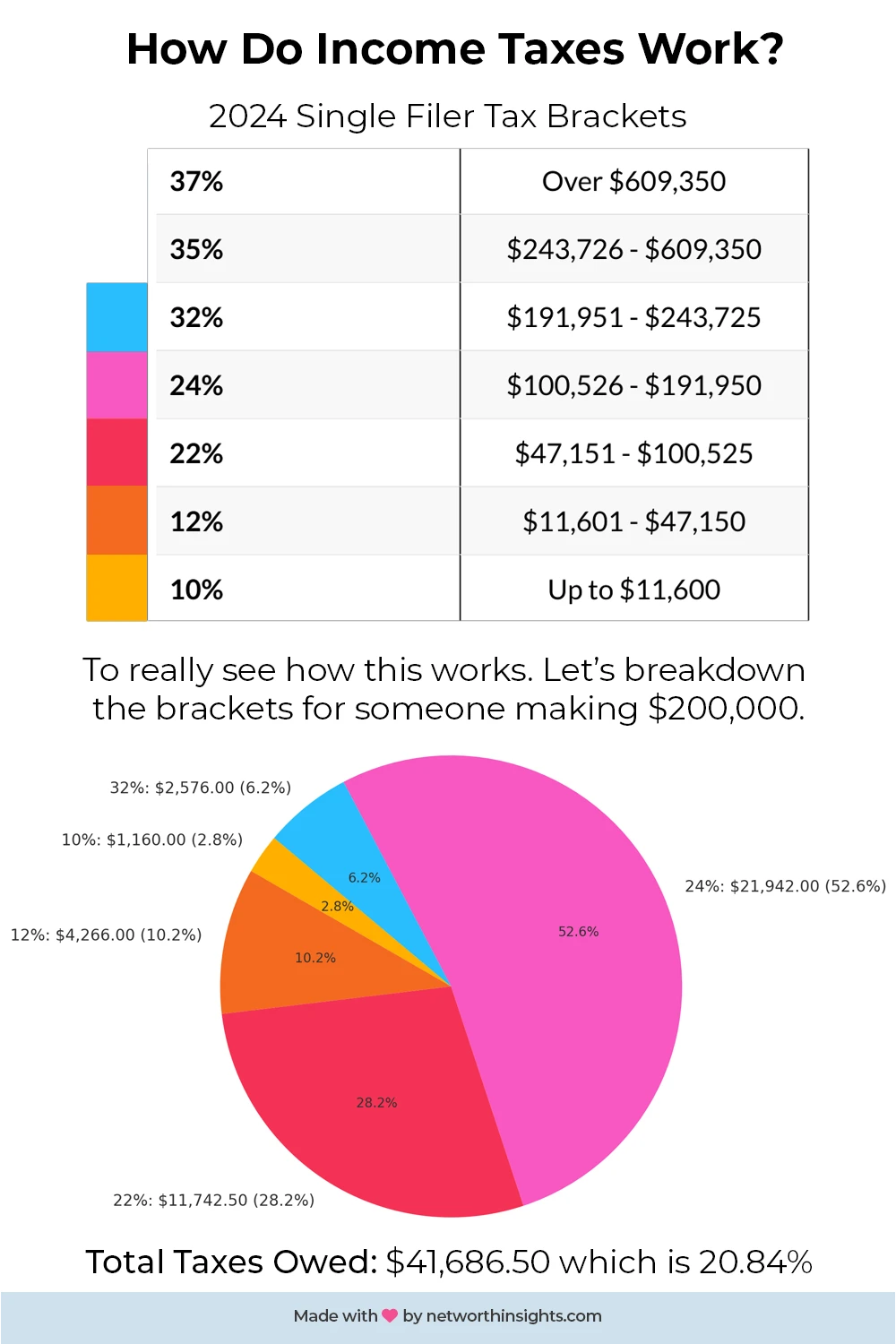

Tax Brackets: In the U.S., income taxes are based on “tax brackets.” This means that different parts of your income are taxed at different rates. For example, if you earn $40,000, part of that money is taxed at a lower rate, and part is taxed at a higher rate.

Progressive Tax System: The U.S. uses a “progressive” tax system. This means that people who make more money pay a higher percentage in taxes. But don’t worry; only the amount above each tax bracket is taxed at the higher rate, not your entire income.

2024 Income Taxes Chart

What People Often Think: “I Don’t Qualify for Any Tax Breaks”

Many people believe they don’t qualify for deductions or credits, but there are many tax breaks available. For instance, if you pay interest on a student loan, you might be able to deduct that. If you have children, you may qualify for the Child Tax Credit. Taking advantage of these can help you save on taxes.

Tax Deductions and Credits

Another part of taxes that people don’t always understand is tax deductions and credits. These can reduce the amount of tax you owe.

Deductions: A deduction lowers the amount of your income that gets taxed. For example, if you give money to charity, you can deduct that amount from your taxable income, which means you’ll owe less in taxes.

Credits: A credit is even better than a deduction because it directly reduces the amount of tax you owe. For example, if you get a $500 tax credit, that’s $500 less you have to pay in taxes.

Myths About Taxes

Let’s go over some common myths about taxes and the truth behind them.

Myth: “Rich People Don’t Pay Taxes”

Reality: While some wealthy people do pay less in taxes thanks to certain tax rules, most high-income earners still pay a significant amount in taxes. They just have more ways to reduce taxes through deductions and credits.Myth: “I Only Pay Federal Taxes”

Reality: Besides federal taxes, you also pay state and local taxes, such as property tax and sales tax. Each state sets its own rules, so these taxes vary depending on where you live.Myth: “Filing Taxes is Always Hard”

Reality: Filing taxes can be simple for many people, especially if they use tax software or work with a professional. Plus, the IRS offers tools and resources to help people file their taxes on their own.

The Benefits of Knowing How Taxes Work

Understanding taxes doesn’t just help you feel more confident; it can actually help you save money. Here’s how:

Smart Financial Planning: Knowing how taxes work can help you make better financial decisions. For example, if you understand tax brackets, you’ll know that getting a raise won’t put you in a worse financial position.

Taking Advantage of Tax Breaks: By understanding deductions and credits, you can lower your tax bill and keep more of your hard-earned money.

Avoiding Surprises: When you know what to expect, you’re less likely to be surprised by the amount you owe or the refund you receive.

Final Thoughts

Taxes are a part of life, but they don’t have to be confusing. By learning how taxes work, you can take advantage of tax breaks, plan your finances better, and feel more in control. Remember, taxes are part of the game of life, and it only hurts you to ignore them. So the next time tax season comes around, you’ll be prepared and ready to make the most of it.