Teaching kids about money early on can be one of the most valuable lessons they learn. Financial literacy games are an incredibly effective way to introduce children to important concepts like saving, budgeting, investing, and money management. These games make learning engaging by combining real-world financial principles with fun, interactive gameplay.

In a world where financial decisions impact almost every aspect of life, these games help children understand the basics of managing resources, making smart choices, and planning for the future. By playing these games, kids can gain a head start in developing critical thinking skills, problem-solving abilities, and a sense of responsibility when it comes to money.

Why Are Games So Effective?

- Interactive Learning: Games actively involve children in decision-making, making abstract concepts like interest, passive income, or opportunity cost much easier to grasp.

- Safe Environment for Mistakes: Players can make financial errors in the game without real-world consequences, helping them learn through experience.

- Fun Factor: Learning is more enjoyable when it feels like play, and games ensure kids stay engaged while building essential skills.

- Builds Confidence: Understanding money at a young age empowers children to feel confident about managing their finances as they grow.

By incorporating these games into family activities or educational settings, parents and teachers can create an enjoyable pathway to financial independence, helping kids develop skills that will last a lifetime. These games aren’t just entertainment—they’re investments in a brighter, more financially secure future for the next generation.

17 Games to Teach Kids About Money

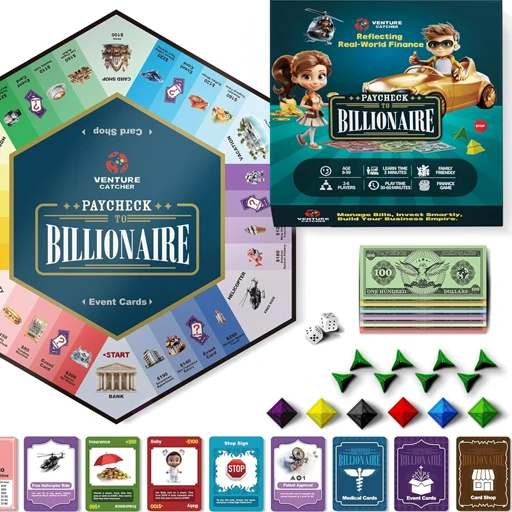

Paycheck to Billionaire (Ages 10+)

Paycheck to Billionaire is a strategic financial literacy game that guides players through the journey from living paycheck-to-paycheck to building wealth and achieving billionaire status. Players make decisions about earning, saving, investing, and managing expenses while navigating real-world financial scenarios like debt and investments.

What Makes It Fun: The game is both competitive and educational, providing a clear progression from financial basics to advanced strategies. Its realistic approach to building wealth, combined with the excitement of aiming for billionaire status, makes it a favorite for families and classrooms alike. The mix of strategy, luck, and financial principles keeps players engaged and motivated to learn.

Lemonade Stand (Ages 7+)

In Lemonade Stand, players take on the role of budding entrepreneurs managing a lemonade business. The game challenges players to set prices, track inventory, and adjust their strategies based on weather conditions and customer demand.

What Makes It Fun: The combination of entrepreneurship, quick decision-making, and adaptability to fluctuating market conditions keeps players engaged. It’s simple yet deeply educational, making it a perfect introduction to business concepts for kids and adults alike.

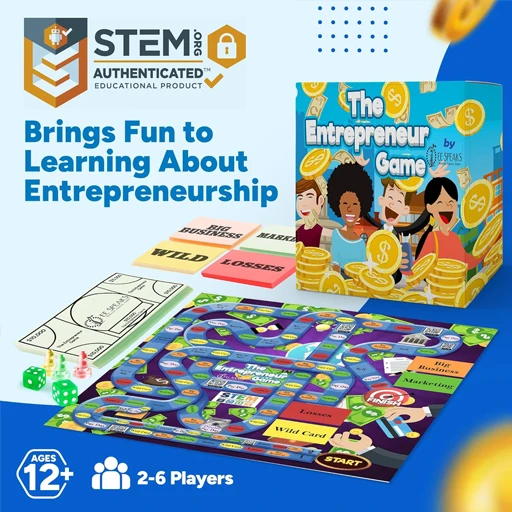

The Entrepreneur Game (Ages 12+)

The Entrepreneur Game is an engaging board game where players build and grow their businesses from the ground up. Players navigate challenges such as securing funding, hiring employees, marketing products, and managing expenses, all while competing to create the most successful business.

What Makes It Fun: The game combines strategy, creativity, and financial literacy in a way that feels realistic and exciting. It encourages players to think like entrepreneurs, fostering innovation and problem-solving skills while teaching valuable lessons about business and money management. Perfect for families, classrooms, or aspiring young entrepreneurs, it’s both educational and inspiring.

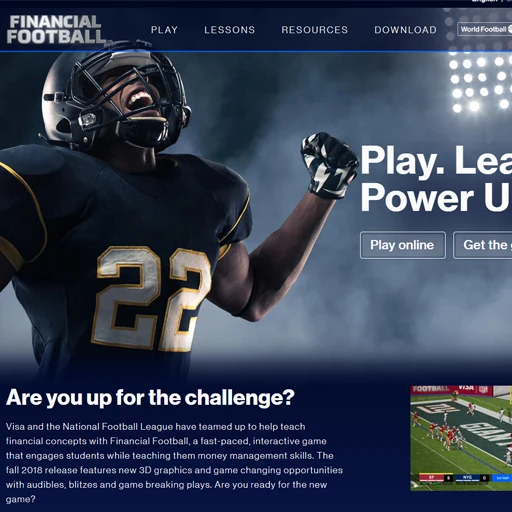

Financial Football (Ages 10+)

Financial Football combines the excitement of football with financial literacy lessons. Players answer finance-related questions to make strategic plays, advancing down the field to score touchdowns.

What Makes It Fun: The competitive format and the gamification of financial education make this an engaging way to learn about budgeting, saving, and investment. It’s particularly appealing for sports fans who enjoy friendly competition while learning.

Stock Exchange Game – Family Friendly (Ages 10+)

Stock Exchange Game is a dynamic board game that introduces players to the fundamentals of trading, investing, and market fluctuations. Players compete to maximize their portfolios by buying, selling, and strategizing around market trends while managing risks.

What Makes It Fun: The game offers a mix of strategy, luck, and realistic stock market mechanics, making it both educational and exciting. Its competitive nature keeps players engaged, while its focus on real-world financial concepts provides a valuable learning experience for kids and adults alike.

Acquire Strategy Board Game (Ages 12+)

Acquire is a classic strategy board game where players act as investors building and merging hotel chains to grow their portfolios. The game focuses on buying stocks, acquiring majority shares, and making strategic decisions to dominate the board and maximize wealth.

What Makes It Fun: The mix of strategic planning, competitive gameplay, and financial decision-making keeps players engaged. With dynamic scenarios and evolving strategies, Acquire offers a rich learning experience in investments, market control, and resource management while delivering hours of fun for families and finance enthusiasts alike.

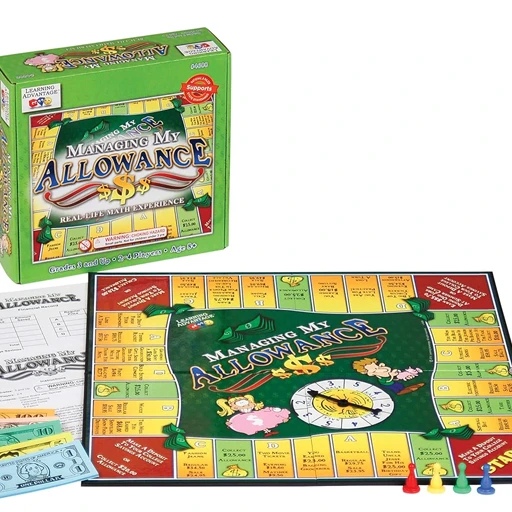

Managing My Allowance (Ages 6–12)

Managing My Allowance is a fun and educational board game where players learn how to handle their weekly allowances. The game focuses on key financial skills like budgeting, saving, spending wisely, and planning for both short-term and long-term goals. Players encounter real-life scenarios, such as unexpected expenses and opportunities to earn extra money.

What Makes It Fun: The relatable gameplay and interactive decision-making make it an engaging way to teach kids financial responsibility. By mimicking real-world challenges, the game helps kids understand the value of money and develop smart financial habits in an enjoyable, hands-on way.

Monopoly or Junior Monopoly (Ages 8+ or 5+)

The classic Monopoly game lets players buy, sell, and trade properties to build wealth and bankrupt opponents. The Junior Edition simplifies the rules for younger players.

What Makes It Fun: The game’s iconic real-estate strategy, the thrill of acquiring properties, and the competitive interactions between players have made Monopoly a timeless classic. It also subtly introduces money management and investment principles.

SimplyFun Bank It! (Ages 7+)

Bank It! is a family-friendly game where players navigate financial decisions by earning, saving, and investing their earnings while avoiding financial pitfalls. Players learn the importance of balancing spending with savings and planning for unexpected expenses.

What Makes It Fun: The simple yet engaging gameplay introduces key money management concepts in a way that’s accessible to kids and enjoyable for adults. Its interactive nature and relatable financial scenarios make it a great way for families to bond while building financial literacy skills.

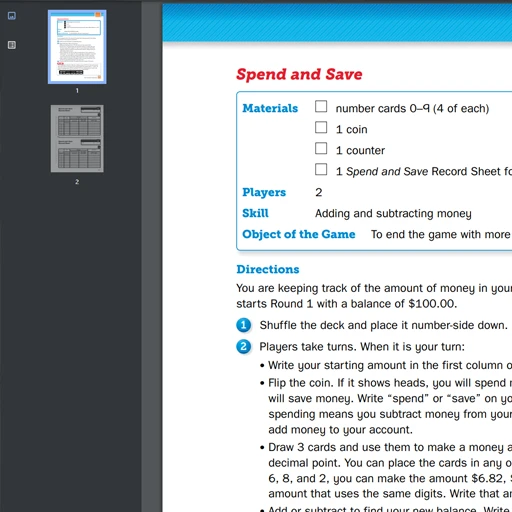

Spend & Save (Ages 6–12)

Spend & Save is a printable financial literacy game designed to teach players how to budget effectively, prioritize expenses, and save for future goals.

What Makes It Fun: The simplicity and accessibility of this game make it an excellent choice for families and educators. Its emphasis on goal-setting and mindful spending resonates with real-world money management principles, offering valuable lessons in a fun and digestible format.

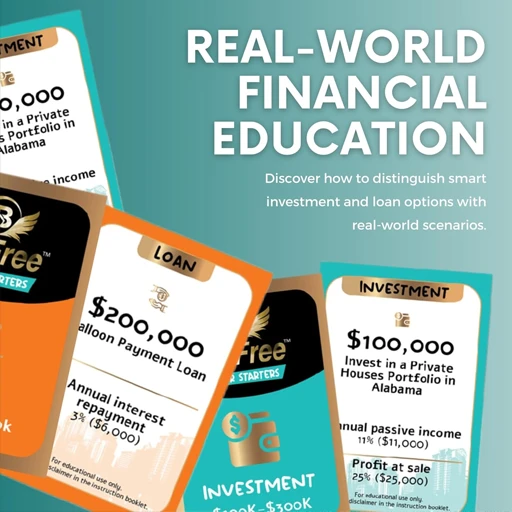

BeFree for Starters Step up for Your First Million (Ages 14+)

BeFree for Starters is a beginner-friendly financial literacy game designed to teach kids and teens the basics of budgeting, earning, saving, and spending. Players make decisions to achieve financial goals while balancing everyday expenses and planning for unexpected events.

What Makes It Fun: The approachable gameplay makes learning financial skills engaging and relatable. Its focus on practical money management, combined with scenarios kids may encounter in real life, creates a strong foundation for developing good financial habits in an enjoyable way.

Market Works (Ages 10+)

Market Works is an engaging board game where players simulate running a business in a competitive market. Players make decisions about production, pricing, supply, and demand while managing resources and navigating market fluctuations. The goal is to outperform competitors and maximize profits.

What Makes It Fun: The dynamic gameplay encourages strategic thinking and real-world problem-solving. Market Works introduces kids to the fundamentals of economics, entrepreneurship, and market dynamics in an exciting and interactive way. Its combination of competition and education makes it a hit for families and classrooms alike.

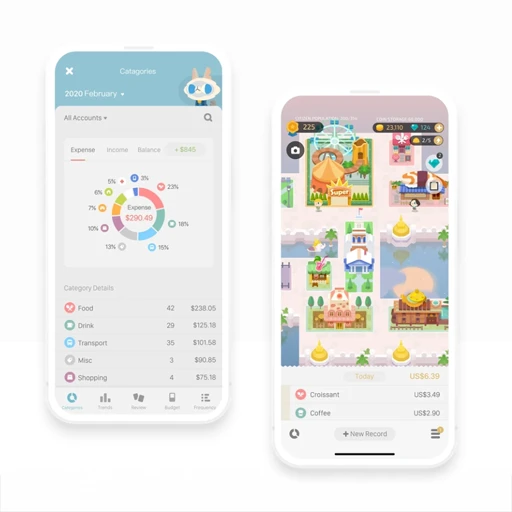

Fortune City (Ages 8+)

Fortune City combines budgeting with city-building, where players use their real-world spending data to grow and manage a virtual city.

What Makes It Fun: The gamified approach to tracking expenses makes budgeting exciting and visually rewarding. It’s great for kids and adults alike.

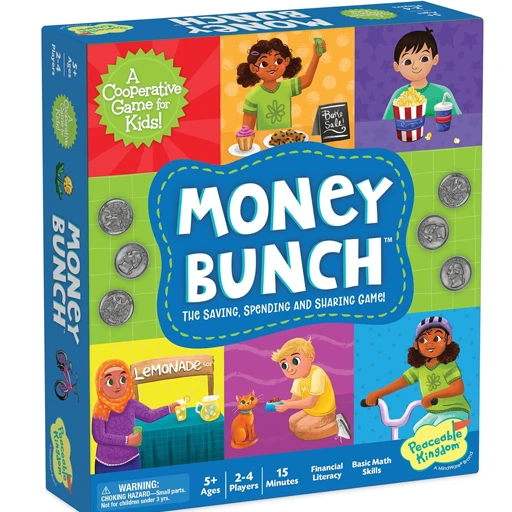

Money Bunch Game (Ages 5–10)

Money Bunch Game is a colorful and engaging game designed to teach younger kids basic money concepts like coin recognition, counting, and making change. Players collect coins, solve money-related challenges, and work towards saving enough for a fun prize.

What Makes It Fun: The bright visuals, simple gameplay, and interactive challenges keep younger kids engaged while building foundational financial skills. It’s a great way to introduce kids to the basics of managing money in a way that feels approachable and fun for early learners.

Cashflow for Kids (Ages 6–12)

Cashflow for Kids introduces players to the concept of financial independence by teaching the importance of earning passive income and escaping the “rat race.” Players invest in assets and manage their expenses to achieve financial freedom.

What Makes It Fun: This game excels in its ability to simplify complex financial concepts into engaging gameplay. Its focus on long-term financial thinking makes it a hit for families and classrooms.

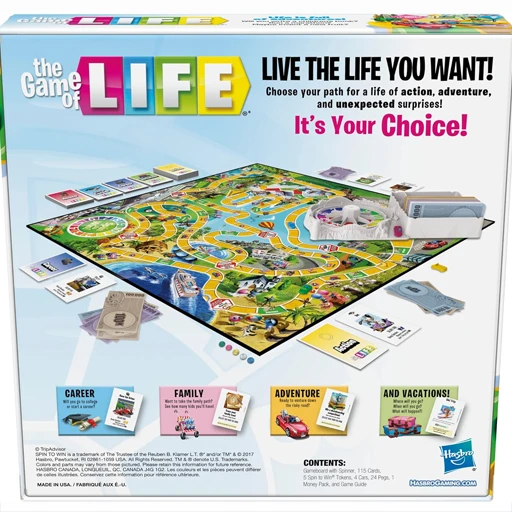

The Game of Life (Ages 8+)

In The Game of Life, players navigate through major life milestones such as college, careers, marriage, and retirement while managing their finances along the way.

What Makes It Fun: The game is a fun simulation of life’s unpredictability, complete with financial ups and downs. Players enjoy making life choices while balancing financial trade-offs, adding an element of realism to the gameplay.

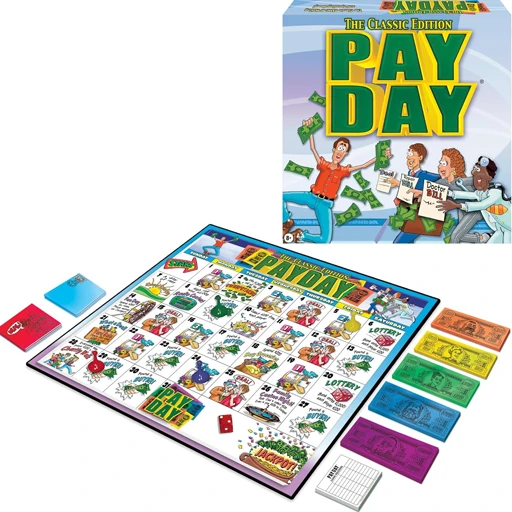

Payday (Ages 8+)

Payday is a classic board game that simulates a month in the life of managing income, expenses, and unexpected events. Players race to accumulate wealth while avoiding financial pitfalls.

What Makes It Fun: The fast-paced gameplay and realistic scenarios—like paying bills, receiving paychecks, and encountering surprise expenses—make Payday both entertaining and educational. It’s a great way to learn budgeting in a lighthearted manner.

Final Thoughts

Financial literacy is a crucial skill that many adults wish they had learned earlier in life. Games provide a unique and effective way to introduce kids to financial concepts in a way that feels less like learning and more like play. By engaging in interactive scenarios, children can explore real-world money challenges like budgeting, saving, investing, and decision-making without real-world consequences.

Games foster critical thinking, problem-solving, and confidence, empowering kids to make smarter financial choices as they grow. They also open the door to meaningful conversations between parents and children about money, creating a foundation for lifelong financial habits.

When children play these games, they’re not just having fun—they’re developing skills that will help them navigate the complexities of personal finance and build a secure future. Whether they’re learning about earning allowances, managing debt, or understanding the stock market, these experiences provide a head start toward financial independence and success.