If getting rich were as easy as that TikTok guru says, your barista wouldn’t be steaming milk—he’d be steaming on a yacht. Yet every scroll serves up another “secret” side-hustle that supposedly turns $100 into a mansion before next Friday.

Here’s the truth most influencers won’t admit: “overnight success” is usually a cleverly edited highlight reel masking years of sweat—or an outright scam. The promise of instant wealth hijacks your brain’s dopamine loop, dangles a Lamborghini-shaped carrot, and nudges you toward risks that only benefit the person selling the dream.

Give me five focused minutes, and I’ll show you:

Why your brain is wired to chase shiny quick-cash traps (so you can spot the manipulation before it empties your wallet).

The 10 red-flag warning signs that separate legit opportunities from ticking time bombs.

A proven, five-step due-diligence playbook you can run on any offer in under 24 hours.

By the end, you’ll have a mental spam filter strong enough to mute the noise, channel your money into strategies that actually compound, and sleep at night knowing you’re on the slow, steady road to real freedom. Let’s dig in.

Why Our Brains Crave “Fast Cash”

We’re all running 200,000-year-old software.

Back in caveman times, grabbing food now meant survival. Your brain still fires that same must-grab signal whenever it sees “double your money overnight.” Marketers know it—and they push every button at once.

1. Dopamine Jackpot

Winning feels great. Seeing somebody else post a $10,000-in-a-day screenshot lights up the reward center in your brain like a slot machine on the Vegas Strip. Your logic circuit? That shows up late to the party—after the money’s already gone.

2. Fear of Missing Out (FOMO)

“Only 24 hours left!” triggers your inner cave-person’s terror of being left without berries for the winter. Countdown timers and flashing alerts override patience and make reckless clicks feel urgent and smart.

3. Social-Proof Pressure

When a 19-year-old “crypto king” leans on a rented Lamborghini, your brain turns off skepticism and thinks, If he cracked the code, why can’t I? You’re comparing your day-one to his highly filtered highlight reel—an unfair fight you’ll lose every time.

4. The Hidden Opportunity Cost

Every dollar hurled at a shiny promise is a dollar that could have been quietly compounding in an index fund, real estate fund, or high-yield cash account. Slow money grows; rushed money blows.

Key Takeaway: Your brain loves “easy money” the way a toddler loves candy—but you’re the adult in charge. Recognize the trigger, breathe, and walk past the sweet-talking sales page. In the next section, we’ll hand you a cheat sheet of 10 Red Flags that expose almost every get-rich trap on sight.

10 Red Flags of a Get-Rich-Quick Scheme

(Screenshot-worthy. If three or more pop up, shut the tab and walk away.)

“Guaranteed” Returns – Real markets guarantee nothing except volatility.

Secret Sauce – “Proprietary algorithm” or “insider tip” they can’t reveal? Translation: trust me, bro.

Clock-Ticking Urgency – Countdown timers, “spots filling fast,” or only today pricing weaponize FOMO so you skip homework.

Up-Front Paywall – You must buy the $997 course before seeing proof. Legit investments don’t hide behind a paywall.

No Audit Trail – They dodge questions about audited statements, third-party verification, or broker/dealer registration.

Complex Jargon Fog – Buzzwords like “quantum AI arbitrage” designed to intimidate, not educate.

Celebrity or Influencer Hype – Flashy endorsements in place of fundamentals (remember FTX’s Super Bowl ad?).

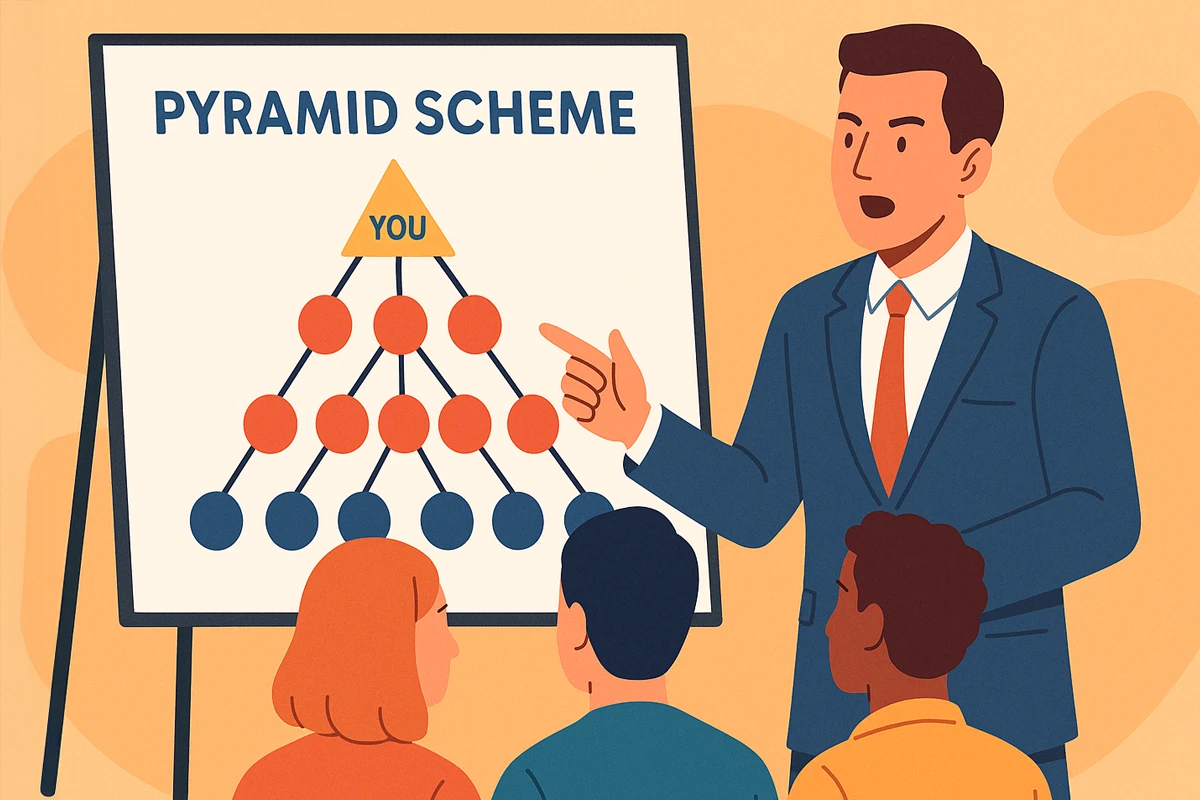

Pyramid-Shaped Rewards – Heavy emphasis on recruiting others for commissions instead of product value.

Asymmetric Risk – You front 100 % of the cash; they shoulder 0 % if it tanks. (Ask, “What happens if this fails?”)

Lifestyle Flex Over Substance – Lambos, rented mansions, private-jet selfies—no talk of audited numbers, downside, or taxes.

Frugal Filter: Would Graham Stephan happily hand over his credit card here? If not, neither should you.

Case-Study Showdown: “Too-Good-to-Be-True” vs. “Boring-But-Rich”

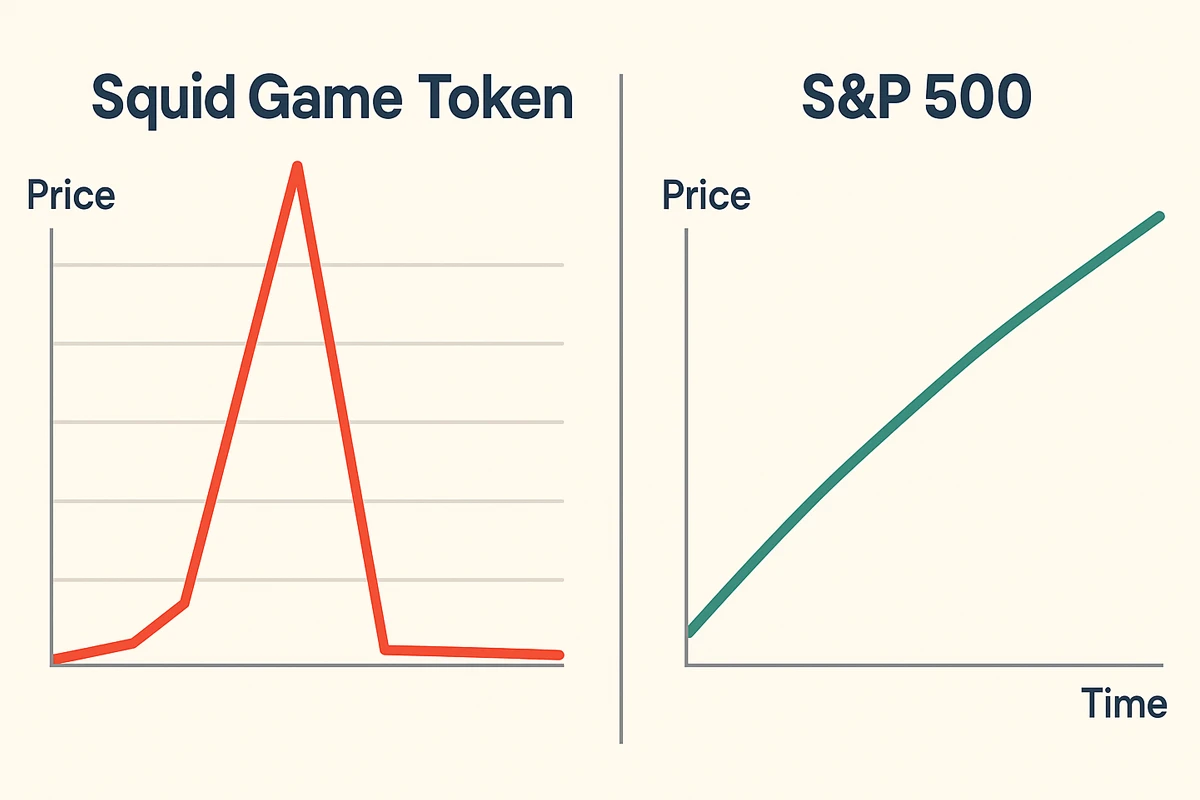

You have $1,000 to invest on October 26, 2021. Do you chase the viral Squid Game ($SQUID) token or put it into a plain-vanilla S&P 500 index fund?

Oct 26 2021 — Entry point

• Flashy path: Buy 1,000 $SQUID tokens at $1 each → $1,000 in.

• Slow path: Buy $1,000 of an S&P 500 index ETF.Oct 30 2021 — Early spike

• $SQUID surges above $38; paper value ≈ $38 k, but holders still can’t sell.

• S&P 500 ETF up about 3 % → $1,030.Nov 1 2021 — Mania peak & crash

• $SQUID price touches $2,861; on paper you’re “worth” $2.8 million—then the devs rug-pull liquidity and price collapses to $0. en.wikipedia.org

• S&P 500 ETF roughly flat.Minutes later

• Flashy path value: $0 (total loss).

• Slow path value: still $1,030.June 10 2025 — Three-and-a-half years later

• Flashy path: still $0.

• Slow path: S&P 500 three-year total return ≈ +43 %, turning your stake into ~$1,430. ycharts.com

Key Lessons

Liquidity is life. If you can’t sell, you don’t own an investment—you own a lottery ticket without a drawing.

Paper gains ≠ spendable gains. Screenshots of six-figure balances mean nothing until dollars hit your bank.

Time beats timing. Three steady years of compounding trumped an “overnight millions” promise that vaporized in hours.

The 5-Step Due-Diligence Playbook

Do this in under 24 hours before a single dollar leaves your wallet.

1. Hit Pause for 24 Hours

Scammers depend on urgency. A one-day cooling-off period resets your dopamine and lets logic regain the wheel.

Screenshot the offer, close the tab, sleep on it.

2. Google the Name + “Scam” (and Scroll Past Page One)

Real horror stories often lurk in forums and subreddits, not slick review sites.

Look for patterns: frozen withdrawals, disappearing founders, or promised “guaranteed” returns.

3. Run the Registration Check

U.S. Investors:

• Search the promoter or firm on the SEC’s Investment Adviser Public Disclosure tool (Investor.gov). investor.gov

• Cross-check FINRA’s BrokerCheck for disciplinary flags or missing licenses. brokercheck.finra.orgRed flag: “We’re too new to be registered.” Translation: “We’re invisible when the cops show up.”

4. Do the Boring Math

Calculate the annualized return they claim.

If it beats the long-term S&P 500 (~10 % per year) by more than 2× with “no risk,” assume marketing, not mathematics.

Quick rule: extraordinary ROI × zero transparency = run.

5. Ask a Boring Millionaire

Find someone who got rich slowly—your CPA, a frugal friend, or that quiet uncle who keeps maxing his 401(k).

If they wince, you just saved yourself tuition at Scam University.

Remember: Schemes thrive on secrecy and speed. Transparency plus time is your built-in lie detector. If an offer can’t survive this five-step x-ray, it doesn’t deserve your hard-earned cash.

Build Wealth — the Unsexy Way

Forget moon-shots. Wealth is a boring flywheel you spin every paycheck.

Automate First, Decide Later (Law 6 tie-in)

Set an automatic transfer the same day your income lands—into a high-yield cash account and investment accounts.

Automation turns “I’ll do it later” into “Already done,” removing willpower from the equation.

Diversify Like You’re Allergic to Drama (Law 8 tie-in)

Core: a low-cost S&P 500 or total-market index fund (expense ratio ≤ 0.10 %).

Satellite: a bond index, maybe a REIT, and a sprinkle of international stocks.

Result: one sector crashes, your plan doesn’t.

Reinvest Every Dividend

Click “DRIP on” (Dividend Re-Investment Plan) so payouts buy more shares automatically.

Compounding is magic; DRIP is the wand.

Slash the Silent Killers—Fees & Taxes

Keep total fund fees under 0.20 %. Anything higher needs a justification stronger than “it’s actively managed.”

Use tax-advantaged wrappers first: 401(k), IRA, HSA. Uncle Sam becomes your silent partner in growth instead of skimming the top.

Review Once a Year, Not Once a Day

Annual check-up: rebalance back to target percentages, raise contributions if income jumped, and verify fees stayed low.

Daily portfolio peeking invites emotional trades. Schedule your curiosity.

Quick Action Challenge:

Tonight, set a recurring monthly transfer—however small—into a low-fee index fund. Tomorrow, you’ll wake up already wealthier than the day before, no Lamborghini ads required.

Recap & 15-Second Action Plan

The Rule:

Fast money is usually fake money. Schemes lure you with dopamine, urgency, and hype—then leave you holding the bag while the promoter cashes out. Real wealth is slow, boring, automatic, and transparent.

What to Remember:

Spot the lure — If it promises guaranteed, outsized returns with zero risk or “secret tech,” hit pause.

Run the 5-Step X-Ray — Search, verify, do the math, and ask a boring millionaire.

Deploy the flywheel — Automate contributions, diversify, reinvest dividends, keep fees low, review yearly.

15-Second Action:

Grab the flashiest “get-rich” pitch you saw this week (screenshot or link). Open a note titled “Law 19 Reality Check.” Write down how many red flags you can spot and why your money is better off compounding quietly elsewhere. Done. Your brain just upgraded its scam filter—and your future net worth will thank you.