Understanding how Social Security benefits are calculated and accessing your personalized estimates are crucial steps in effective retirement planning. Here’s a concise guide to help you navigate this process.

Qualifying for Social Security Benefits

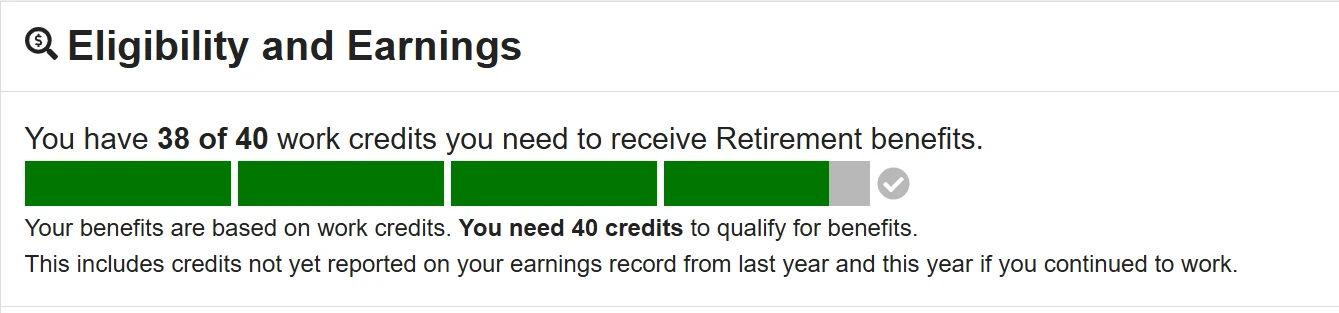

To be eligible for Social Security retirement benefits, you need to accumulate at least 40 work credits, which equates to approximately 10 years of employment. As of 2025, you earn one credit for every $1,640 in earnings, up to a maximum of four credits per year.

Calculating Your Benefit Amount

Social Security benefits are determined based on your lifetime earnings, specifically focusing on your highest 35 years of income.

The calculation involves several key steps:

Indexing Your Earnings

Your annual earnings are adjusted to account for changes in average wage levels over time, ensuring your benefits reflect the standard of living during your working years.

Computing Average Indexed Monthly Earnings (AIME)

The SSA selects your 35 highest-earning years, sums them, and divides by 420 (the number of months in 35 years) to determine your AIME.

Determining Your Primary Insurance Amount (PIA)

A formula is applied to your AIME using specific bend points, which are adjusted annually. For individuals turning 62 in 2025, the PIA is calculated as follows:

- 90% of the first $1,174 of your AIME, plus

- 32% of your AIME over $1,174 and up to $7,078, plus

- 15% of your AIME over $7,078.

PIA=(90%× up to $1,174)+(32%×$1,174 to $7,078 )+(15%× above $7,078)

This gives you a rough estimate, but you will also receive cost of living increases and could be eligible for other bonuses.

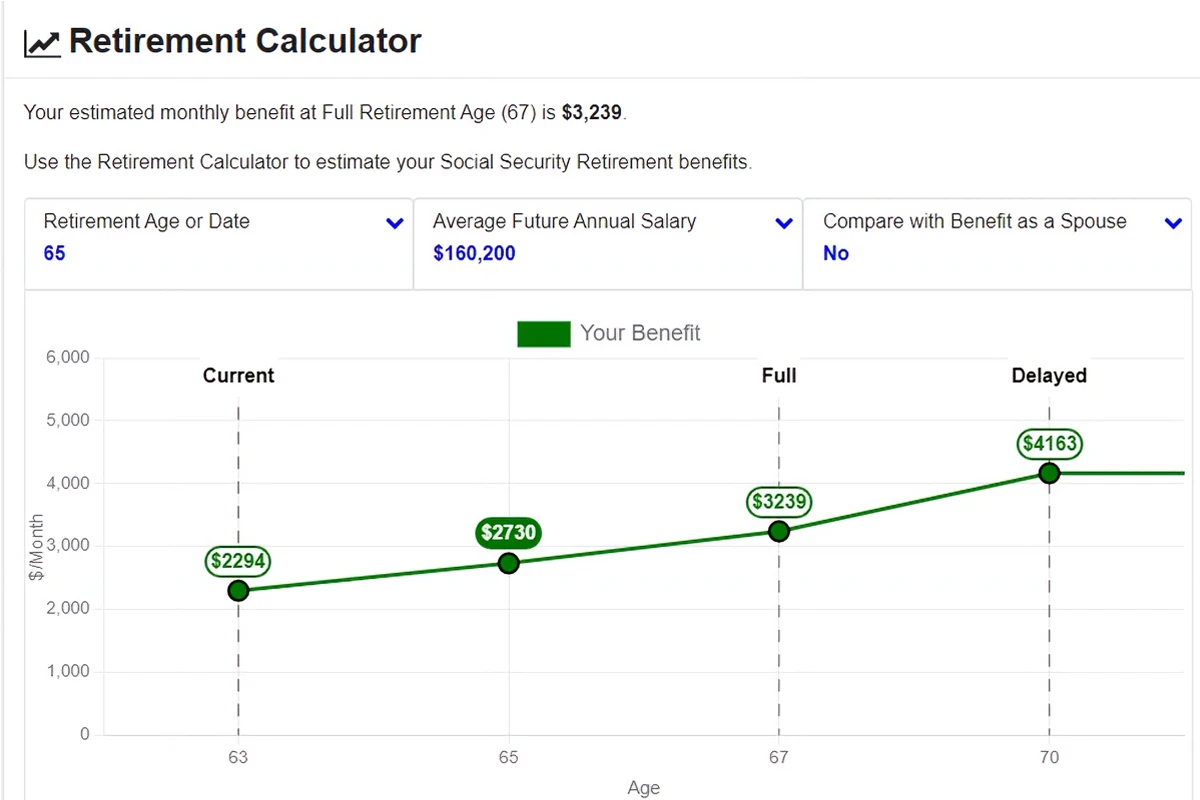

Example of What Your Benefits Could Look Like

If you earned $50,000 per year for 35 years, your estimated Primary Insurance Amount (PIA)—which is your Social Security benefit at full retirement age—would be approximately $2,014 per month in today’s dollars.

This amount could be higher or lower based on factors like cost-of-living adjustments (COLA), wage indexing, and when you decide to claim benefits. Claiming before full retirement age (as early as 62) would reduce your benefit, while delaying past your full retirement age (up to 70) would increase it

Here’s a breakdown of your estimated monthly Social Security benefits based on different claiming ages:

- Age 62: $1,410 per month

- Age 63: $1,511 per month

- Age 64: $1,611 per month

- Age 65: $1,746 per month

- Age 66: $1,879 per month

- Age 67 (Full Retirement Age): $2,014 per month

- Age 68: $2,175 per month

- Age 69: $2,337 per month

- Age 70: $2,498 per month

This illustrates how claiming early reduces benefits, while delaying past Full Retirement Age increases them. Let me know if you’d like additional insights!

Accessing Your Personalized Benefit Estimates

To view your specific Social Security benefit estimates, you can create a personal “my Social Security” account through the SSA’s online portal. This account provides access to your earnings history, estimated benefits, and other essential services.

Steps to Create Your Account Using Login.gov

Visit the SSA Website

Navigate to www.ssa.gov/myaccount.

Choose a Sign-In Method

Select the option to create an account using Login.gov.

Create a Login.gov Account

- Enter your email address and confirm it.

- Create a strong password.

- Set up a method for two-factor authentication to enhance security.

Link to SSA

After setting up your Login.gov account, you’ll be redirected back to the SSA website to complete the process.

Verify Your Identity

Provide personal information, such as your Social Security number and address, and answer security questions to confirm your identity.

Access Your “my Social Security” Account

- Visit the Social Security Administration’s website: www.ssa.gov/myaccount.

- Sign in using your credentials.

- Once logged in, you’ll have access to your personalized dashboard.

- Here, you can view your estimated benefits at different retirement ages, your earnings record, and other relevant information. You can also view how many credits you need until you qualify.

Wrap up

In conclusion, understanding how Social Security benefits are calculated and accessing your personalized benefit information are essential steps in effective retirement planning. By creating a personal “my Social Security” account through the Social Security Administration’s website, you can securely view your earnings history, estimate future benefits, and manage your information online. Regularly reviewing this data ensures that your records are accurate and helps you make informed decisions about your retirement strategy. Taking these proactive steps will aid in securing your financial future and achieving your retirement goals.