In 2025, wealth has a new wardrobe. It’s minimalist, monochrome, and suspiciously logo-free. Gone are the days of flashy designer monograms and head-to-toe branding; today’s elite prefer their affluence understated. Welcome to the era of quiet luxury—where success whispers through cashmere, tailored silhouettes, and heirloom jewelry that only the initiated recognize. It’s the aesthetic of generational wealth, of “old money” elegance, and it’s dominating everything from TikTok to Vogue. But while the look may be subtle, its influence is anything but.

Scroll through social media and you’ll see influencers sipping matcha in muted tones, lounging in homes that look like Architectural Digest exploded in beige. The captions read “effortless” and “timeless,” but the reality behind the scenes is often anything but. Many of these curated lifestyles are funded by credit cards, Buy Now Pay Later apps, and brand sponsorships—not trust funds. The pressure to emulate this aesthetic has created a culture where people feel compelled to spend beyond their means just to appear financially secure. It’s not just about fashion—it’s about signaling status, even if that signal is built on shaky financial ground.

This disconnect between appearance and reality has birthed a new phenomenon: loud debt disguised as quiet luxury. People are drowning in monthly payments for designer bags, luxury skincare, and curated interiors, all in the name of looking like they “have it together.” But behind the filters and neutral palettes lies a louder truth—many are barely scraping by. It’s a financial illusion that’s emotionally exhausting and economically dangerous. So let’s unpack the aesthetic trap, the emotional toll it takes, and how to build real wealth that doesn’t need a filter to shine.

👗 What Is Quiet Luxury—and Why Is It Trending?

Quiet luxury is the aesthetic of understated wealth. Think Bottega Veneta bags with no logos, Loro Piana sweaters, and homes that scream “architecturally curated” but whisper “I have a trust fund.” It’s the opposite of loud fashion—no flashy branding, no neon flexing.

But here’s the twist: while the 1% may genuinely live this way, social media has democratized the look, not the lifestyle. Influencers and aspirational consumers are mimicking quiet luxury while financing it with credit cards, Klarna, and a prayer.

📉 Loud Debt: The Hidden Cost of Looking Rich

According to recent data:

- Credit card debt hit $1.3 trillion in 2025, with the average millennial carrying $6,434 in revolving balances

- Buy Now, Pay Later usage is up 32%, especially for fashion and beauty purchases

- 40% of Gen Z and millennials admit to buying luxury items for social media content—even if they can’t afford them

💡 Example: That $2,800 “quiet luxury” coat may look timeless, but if it’s sitting on a 24% APR credit card, it’ll cost you $3,472 over time. That’s not elegance—it’s financial erosion.

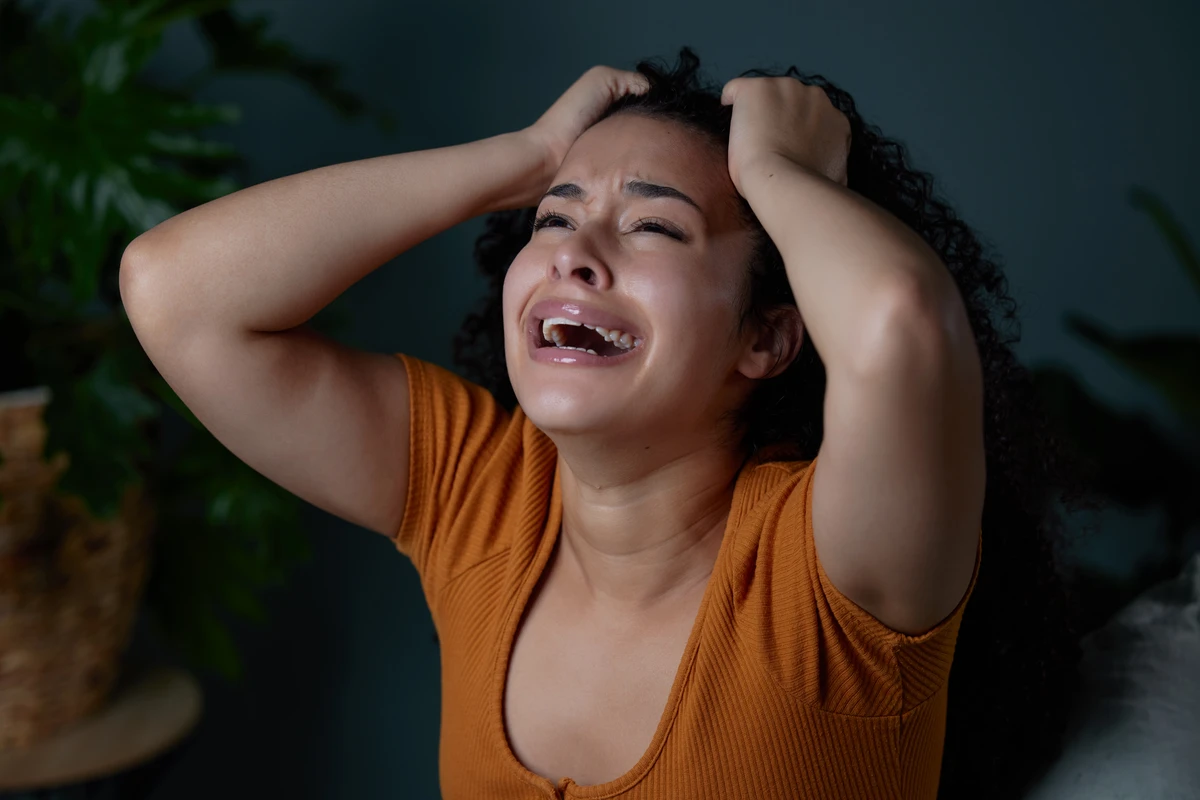

😩 The Emotional Toll of Financial Aesthetic Pressure

Trying to keep up with curated feeds and influencer lifestyles leads to:

- Financial anxiety: Constant stress about bills, balances, and budgeting

- Imposter syndrome: Feeling like a fraud for projecting wealth you don’t have

- Delayed goals: Postponing savings, investments, and even family planning to maintain appearances

It’s the modern version of “keeping up with the Joneses”—except now, the Joneses have filters, affiliate links, and a brand deal with Dior.

🛠️ How to Break the Cycle and Build Real Wealth

1. Audit Your Spending Aesthetic

Ask yourself: Am I buying this because I love it—or because I want to be seen with it? Track purchases that were made for “the look” vs. actual utility.

2. Unfollow the Pressure

Curate your feed like you curate your closet. Follow creators who talk about financial literacy, slow fashion, and realistic lifestyles. Mute the ones who make you feel behind.

3. Set Style & Savings Goals

You can still love fashion and aesthetics—just budget for it. Create a “luxury sinking fund” and pay cash for statement pieces. No debt, no guilt.

4. Invest in Assets, Not Just Outfits

Instead of spending $500 on a trending bag, consider:

- $500 in an index fund = ~$1,000 in 10 years

- $500 toward a certification = $10K+ salary bump

- $500 toward debt = hundreds saved in interest

💡 Quiet wealth isn’t about what you wear—it’s about what you own.

💬 Final Thoughts: Don’t Just Look Rich—Be Rich (On Your Terms)

Quiet luxury is undeniably beautiful—its elegance lies in restraint, in the confidence to let quality speak without shouting. But real wealth goes beyond aesthetics; it’s quiet and powerful in a way that doesn’t need validation. True financial strength is the ability to say no to debt, yes to freedom, and build a life that feels good—not just looks good on a curated feed. It’s about making choices that align with your long-term goals, not your short-term image. So the next time you’re tempted to swipe your card for the sake of the aesthetic, pause and ask yourself: Is this feeding my ego or my future? Because the most luxurious thing you can own is peace of mind—and that never goes out of style.