As your income grows, it’s easy to start spending more. Maybe you want a bigger house, a nicer car, or to dine out more often. This is called lifestyle inflation—when you increase your spending as your earnings rise. While it’s natural to want to enjoy the fruits of your hard work, lifestyle inflation can harm your long-term financial growth if you’re not careful. Let’s dive into what lifestyle inflation is, why it’s dangerous, and how you can avoid falling into its trap.

What is Lifestyle Inflation?

Lifestyle inflation happens when your spending goes up each time you get a raise or earn more money. For example, instead of sticking with your current car, you might decide to upgrade to a luxury model when your salary increases. Over time, these small spending increases add up and become part of your normal budget, leaving you with little extra money to save or invest.

While rewarding yourself occasionally is fine, letting your spending grow with your income can prevent you from building wealth. It can even make it harder to reach important financial goals like saving for retirement, buying a house, or building an emergency fund.

The Hidden Dangers of Lifestyle Inflation

Reduced Savings

One of the biggest problems with lifestyle inflation is that it limits how much you can save. When all your extra income goes toward new expenses, you have less left to save for your future. This can hurt your long-term financial security and make it harder to achieve financial freedom.

Living Paycheck to Paycheck

Even with a higher salary, lifestyle inflation can cause you to live paycheck to paycheck. If your spending grows as fast as your income, you might not have much money left over at the end of the month. This can lead to financial stress, especially if you face unexpected expenses like medical bills or car repairs.

Delayed Financial Goals

Lifestyle inflation can push your financial goals further away. For example, if you spend most of your raise on luxury items, you’ll have less money to save for a house, pay off debt, or invest in your future. Delaying these goals can make it harder to achieve them in the long run.

Increased Debt

When people spend more than they earn, they often rely on credit cards or loans to cover their expenses. This can lead to high-interest debt, which can be difficult to pay off. As debt grows, you’ll end up paying more in interest, reducing the amount of money you have for saving and investing.

Less Financial Freedom

Lifestyle inflation can reduce your financial flexibility. When you spend more, you may feel trapped in your current job because you need to maintain your income to cover your expenses. This can make it harder to take risks, such as switching careers or starting a business, because you’ll feel tied to your paycheck.

How to Avoid Lifestyle Inflation

The good news is that you can avoid lifestyle inflation by making smart financial choices as your income grows. Here are a few ways to keep your spending in check:

Set Clear Financial Goals

Having specific financial goals can help you stay focused on what matters most. Instead of spending your raise on non-essential purchases, put that extra money toward goals like building an emergency fund, saving for retirement, or paying off debt.

Live Below Your Means

Living below your means means spending less than you earn. As your income increases, try to keep your lifestyle the same and save the difference. By controlling your spending, you’ll have more money to invest and grow your wealth over time.

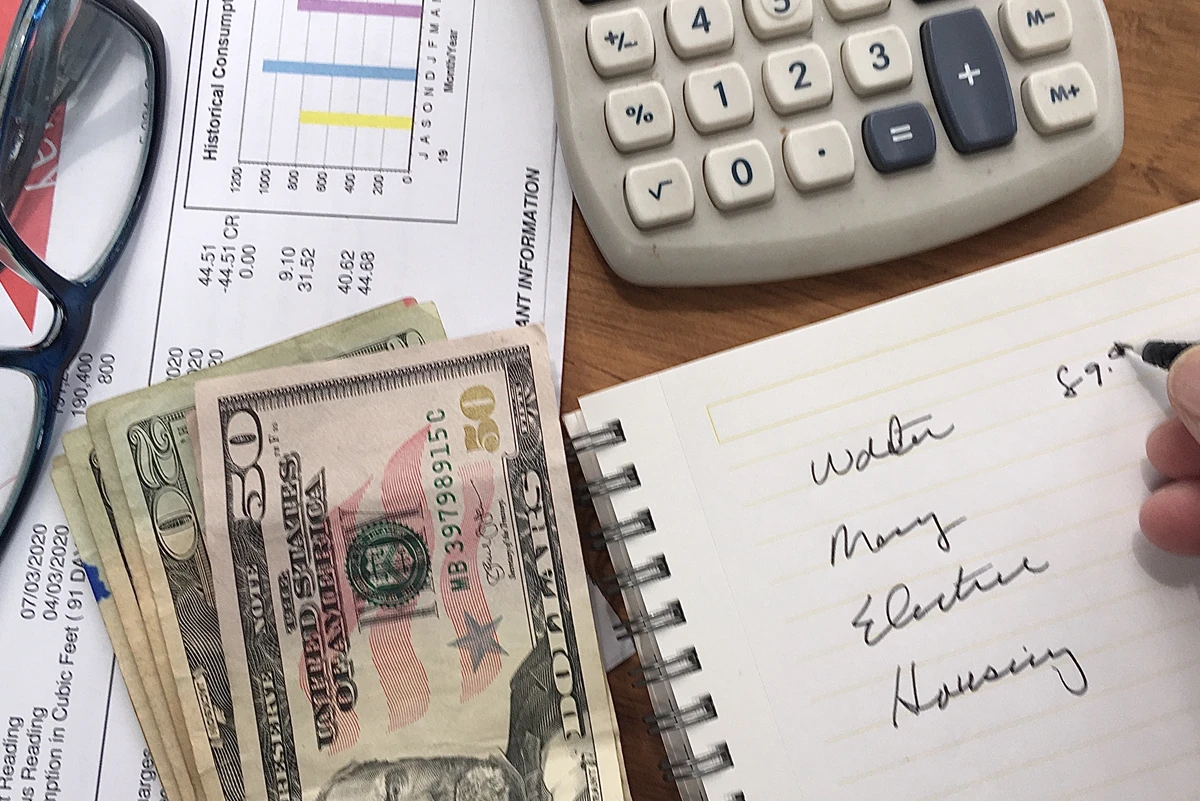

Track Your Spending

Monitoring where your money goes can help you identify areas where you might be overspending. Use a budgeting app or spreadsheet to track your expenses and ensure that your spending is in line with your goals.

Automate Your Savings

One of the easiest ways to avoid lifestyle inflation is to automate your savings. Set up automatic transfers to your savings or investment accounts whenever you get paid. This ensures that you’re consistently saving before you have a chance to spend the money.

Enjoy Your Money Wisely

It’s okay to reward yourself for hard work, but do it in moderation. Set aside a small portion of your raise for fun activities or purchases, but make sure the majority goes toward saving and investing. This way, you can enjoy your income boost without letting lifestyle inflation take over.

Conclusion

Lifestyle inflation may seem harmless at first, but over time it can prevent you from reaching your financial goals and building lasting wealth. By being mindful of your spending, setting financial goals, and living below your means, you can avoid the dangers of lifestyle inflation. Remember, it’s not about how much you earn—it’s about how much you save and invest that determines your financial success in the long run. Stay focused on your future, and you’ll be on the path to financial freedom.