Picture two friends with the same salary and savings. Friend A pays cash for everything and waits years to scrape together enough for investments. Friend B borrows at 6 % to buy a cash-flowing rental that pays 12 %. Ten years later, Friend B owns three properties, while Friend A is still saving for the first down payment.

That gap isn’t luck—it’s leverage.

Here’s the truth most banks won’t tell you:

Smart debt was never created for everyday consumers; it was engineered for businesses that could turn borrowed dollars into bigger profits. When you use debt the way a CFO does—only to buy assets that out-earn the interest—you compress time, multiply your earning power, and let other people’s money accelerate your wealth curve.

Used carelessly, debt makes you the product, padding someone else’s balance sheet with late fees and double-digit interest. Used strategically, it’s the most powerful legal cheat code in finance.

In this law you’ll learn:

How to spot “business-grade” leverage in a sea of toxic consumer credit.

The Rule-of-Three test that instantly flags bad loans.

Specific debt instruments (from HELOCs to SBA loans) and when to deploy each.

A five-step framework to stress-test, monitor, and exit any borrowed capital safely.

Master these moves, and you’ll chop years—maybe decades—off your journey to financial freedom.

Debt 101: Good vs. Bad — Kill the Myths

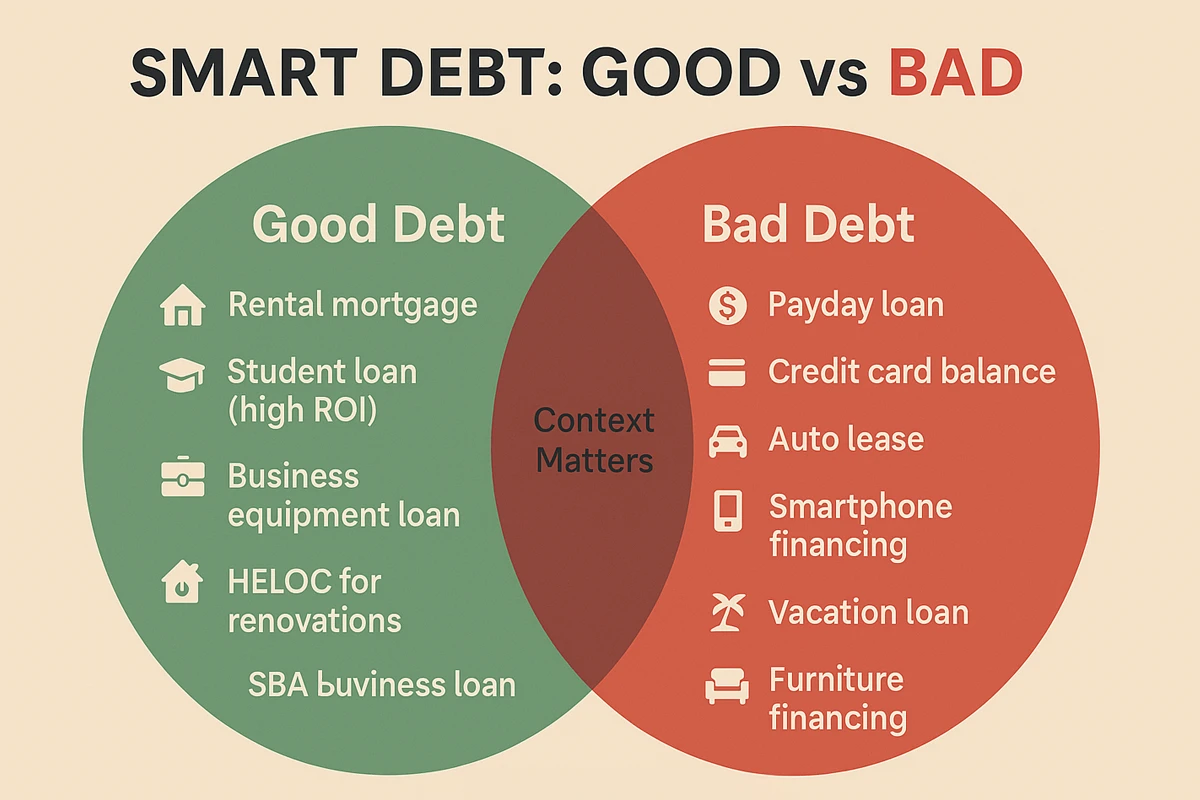

Bottom line: Smart debt was designed for businesses to multiply cash—not for consumers to fund lifestyle sugar-highs.

1.1 How We Got Here

Business Roots: Banks first lent to factories, farms, and property developers—people turning $1 of borrowed money into $1.40 of revenue.

Consumer Detour: In the 1980s credit-card companies discovered households as a profit center. Now the average American carries four cards at double-digit interest for depreciating “stuff.”

1.2 The Business Litmus Test (Rule of 3)

Positive Spread — After-tax ROI beats after-tax interest.

Cash-Flow Coverage — DSCR ≥ 1.25 (every $1 in payments backed by $1.25 in reliable cash).

Exit Plan — Refinance, sell, or amortize on a set timeline.

🚫 Fail any one? It’s bad debt.

✅ Pass all three? It’s business-grade leverage.

1.3 Rapid-Fire Examples

Good Debt (Business-Grade Leverage)

- 30-year fixed rental mortgage at 6 % earning 9 % cash-on-cash.

- HELOC funding a value-add home renovation with a projected 20% ROI.

- SBA 7(a) loan to acquire a cash-flowing franchise with DSCR 1.5.

- 0 % intro business credit card to flip inventory in 90 days for a 30 % margin.

Bad Debt (Consumer Traps)

- 7-year auto loan on a rapidly depreciating SUV.

- 24-month carrier financing for the latest smartphone.

- A high-interest personal loan to pay for a vacation.

- Revolving credit-card balance for designer clothes.

1.4 Mindset Shift

- Ask the CEO Question: “Would our CFO approve this if it were company money?”

- Asset First, Debt Second: Secure or create the cash-producing asset before borrowing.

- Automate Accountability: Track DSCR and LTV monthly with Rocket Money, Ally buckets, or a simple spreadsheet—let math, not emotion, drive the decision.

Key Takeaway: Treat every borrowing decision like a corporate investment memo. If the numbers don’t sing, walk away.

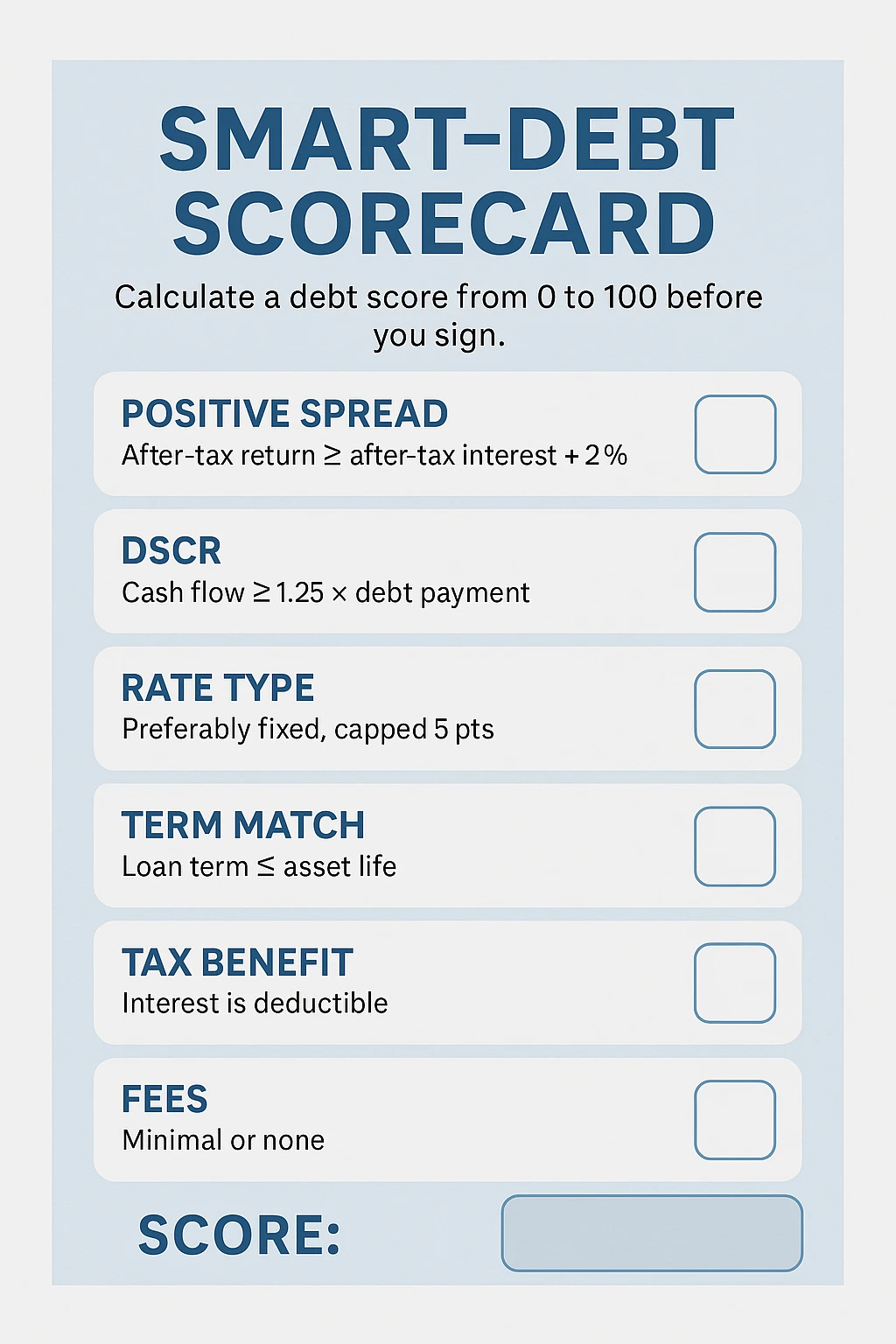

The Smart-Debt Scorecard — Judge Any Loan in 60 Seconds

Smart borrowing starts with numbers, not feelings. Before you sign anything, run the loan through a six-point “smart-debt” filter: positive spread, DSCR, rate type, term match, tax benefit, and fees. In plain English, you want your after-tax return to beat the after-tax interest rate by at least two percentage points, your cash flow to cover payments by 25 percent or more, a fixed (or at least capped) rate, a payoff timeline that doesn’t outlast the asset, deductible interest, and negligible junk fees or prepayment traps.

To turn that checklist into a go/no-go in under a minute, assign each factor a weight that reflects its real-world impact. Give spread 30 points, DSCR 25, term match 15, fixed-rate security 10, tax deductibility 10, and fee hygiene 10. Score each item, total to 100, and let the math decide: 80–100 means green-light business leverage, 60–79 is tweak-or-walk, anything below 60 is a hard pass. The weighting forces discipline—no single “shiny” feature can hide a fundamental weakness.

Here’s the test in action. A $250 k rental mortgage at 6 percent fixed, throwing off 9 percent net cash-on-cash, clears a three-point spread (18 points). With a 1.40 DSCR it earns 22 more. Fixed rate adds 10, a 25-year amortization on a 30-year asset nets the full 15, the interest is deductible for 10, and a one-percent origination fee with no prepay penalties grabs the last 10. Total: 85. That’s smart debt—use it.

Set up a simple Google Sheet (or your budgeting app of choice) so you can input terms on the spot and let conditional formatting flag anything scoring under 75. Pair that live scorecard with automated cash-flow tracking—Ally buckets, Rocket Money, whatever keeps the DSCR front and center. If the score drifts, refinance or accelerate payoff before the loan drags you under.

Bottom line: a lender’s sales pitch can’t out-talk arithmetic. Run the scorecard every time; if the loan won’t crack 80, you don’t sign—no exceptions.

Top Vehicles & When to Use Them

Leverage only works when the tool matches the job. Below are the eight most common “smart-debt” vehicles, the situations they shine in, what today’s terms look like, and the land mines to watch for.

Instrument | Best Use Case | Typical Terms (June 2025) | Key Gotchas |

HELOC | Value-add renovations / bridge funding / consolidate high-interest debt | Variable prime 7.50% + 0–1 pt (6.7%–8.3%); 5–10 yr interest-only draw; 10–20 yr repayment | Rate resets; home is collateral; lender can freeze line |

30-yr Fixed Rental Mortgage | Long-term buy-and-hold real estate cash flow | 6.82% 30-yr fixed; up to 80% LTV; 30-yr amortization | Closing costs; possible prepay penalty; vacancy risk |

SBA 7(a) Loan | Acquire or expand small business / franchise, working capital | Prime 7.50% + ≤3 pts (≤10.5%); up to 25-yr term; guarantees up to 85% | Heavy paperwork; personal guarantee; upfront fees |

Business Line of Credit | Seasonal inventory or working capital swings | 8%–20% APR; revolving; interest only on draws | Variable rate; renewal/maintenance fees; may require collateral |

0% Intro Business Card | Short-cycle inventory flips or launch ads | 0% APR for 12–18 mo, then 15–25%+; limits $10k–$50k | High APR after intro; utilization hurts credit score; late fee kills promo |

Margin Loan | Opportunistic stock buys without selling holdings | 8% large balances; 11–13% small balances | Margin calls; forced liquidations if equity drops |

Seller-Financed Note | Purchase small business or off-market property where banks balk | 5–8% interest; 3–10 yr amort.; low down | Balloon due clauses; due-on-sale if underlying lien exists |

Equipment Loan | Income-producing gear that pays for itself | 7.5%–24%; term equals asset life (3–7 yrs) | Gear is collateral; resale value can fall fast |

Quick-Select Guide

Need long, cheap money for real estate? 30-yr fixed rental mortgage.

Need flexible, revolving cash? HELOC or Business LOC.

Buying or scaling a business? SBA 7(a) first; seller note if the seller will play ball.

Bridging < 18 months? 0 % business card (but pay it off before the cliff).

Chasing fast market trades? Margin only if you understand call risk.

Tool has to earn its keep: If the asset’s ROI doesn’t clear your after-tax cost plus a safety margin, it’s not smart debt—walk away.

The 5-Step Smart-Debt Framework — Your “Pre-Flight” Checklist

Borrow like a business, not like a shopper. Run every loan through these five moves before you lift off.

Step 1 – Set a Clear ROI Target

- Decide exactly how much profit the borrowed money must earn.

- Rule of thumb: aim for at least double the after-tax interest rate (e.g., 6 % loan → 12 %+ net return).

- If the deal can’t hit that hurdle on paper, stop here—no spreadsheet sorcery will fix it.

Step 2 – Stress-Test the Cash Flow

- Pretend rates jump 3 percentage points overnight or revenue falls 20 %.

- Your Debt-Service-Coverage Ratio (DSCR) should still clear 1.25 in that ugly scenario.

- Can’t pass the stress test? Either renegotiate terms or wait for a stronger deal.

Step 3 – Stack Your Safety Net

- Insurance: Protect the asset (property, equipment, or business).

- Liquidity Buffer: Keep three months of loan payments parked in a high-yield cash account.

- Diversification Check: Make sure this one loan won’t push total debt past 40 % of your net worth.

Step 4 – Automate the Money Flow

- Payments: Set auto-draft from a dedicated account so you never miss a due date.

- Tracking: Use Rocket Money, Ally “Buckets,” or a simple Google Sheet to log DSCR, balance, and cash yield monthly—green if DSCR ≥ 1.25, yellow 1.10–1.24, red below 1.10.

- Alerts: Create a rule that pings you if the loan’s scorecard ever drops below 75.

Step 5 – Map the Exit Before You Enter

- Pick one: refinance, sell, or fully amortize—and write the target date on your calendar.

- Mark a trigger point (e.g., rates fall 1 %, equity hits 30 %, or DSCR rises to 1.50) that tells you it’s time to execute.

- Keep a backup plan (emergency sale, partner buy-out, or accelerated payoff) so you’re never cornered by a lender.

If a loan survives all five steps, it’s business-grade leverage. If it trips on any single step, treat it like expired milk—put it back on the shelf and walk away.

Pitfalls & How to Dodge Them

Over-leveraging in a rate spike

- Why it hurts: a 2-point jump can flip positive cash flow negative.

- Fix: keep total loan payments ≤ 35 % of take-home income and favor fixed-rate loans.

Mismatching durations

- Why it hurts: funding a 10-year asset with a 2-year balloon sets a ticking bomb.

- Fix: match the loan’s term to the asset’s life or lock in a refinance clause up front.

Variable-rate amnesia

- Why it hurts: teaser rates reset just as revenues dip.

- Fix: stress-test at +3 % and refinance to fixed the moment DSCR hits 1.40.

Thin liquidity buffer

- Why it hurts: one vacancy or late invoice sparks missed payments and credit damage.

- Fix: park three months of debt service in a high-yield cash account—hands off.

Fee & penalty creep

- Why it hurts: junk origination and prepay fees quietly crush your spread.

- Fix: demand a full fee sheet; walk if extras push the effective rate more than 2 % above headline cost.

Margin-call mayhem

- Why it hurts: falling markets force brokers to liquidate good positions at the worst price.

- Fix: cap margin at 25 % of portfolio value and set stop-loss alerts.

Mixing personal & business debt

- Why it hurts: a default or lawsuit pierces the veil and drains personal assets.

- Fix: use an LLC, separate banking, and corporate cards—never co-mingle funds.

Emotional FOMO borrowing

- Why it hurts: hype overrides math; bad deals get green-lit.

- Fix: run the scorecard cold—no loan scoring under 80 points, ever.

Leverage isn’t risky—mismanaged leverage is. Keep a safety buffer, match terms to the asset, lock rates when you can, and let data—not dopamine—make the call.

Conclusion — Turn the Bank’s Money Into Your Growth Engine

Smart debt is neither friend nor foe—it’s a power tool. In the right hands, it trims years off your timeline to financial freedom; in the wrong hands, it carves holes in your wallet. The difference isn’t luck or IQ—it’s process. Use the scorecard to vet every loan, follow the five-step framework to bullet-proof your cash flow, and keep a watchful eye on the classic pitfalls that turn leverage lethal. Treat each borrowing decision like a corporate investment memo: if the math sings, move; if it squeaks, scrap it.