Buying your first home is one of the biggest financial decisions you’ll ever make. For many people, it’s tempting to go big—dream homes, extra bedrooms, and luxurious finishes. But what if there’s a smarter way? The choices you make with your first home can set the stage for either financial success or constant struggle. Let’s look at two different paths, using the example of Emily and Mike, to see how making a more conservative choice early on can result in far greater financial freedom down the road.

Let’s Compare Two Different Approaches

Emily’s Smart Investment Strategy

Emily decides to buy a modest starter home for $150,000. She makes sure her monthly housing expenses are manageable, spending only a quarter of her income on the mortgage and related costs. With her budget under control, she has an extra $1,000 left over each month, which she chooses to invest in the stock market. Historically, the stock market has returned an average of 10% annually. After 8 years, Emily’s $1,000 monthly investment has grown to about $150,000, including investment gains—not just her contributions.

Mike’s Big Home Gamble

On the other hand, Mike chooses to stretch his budget and buy a $400,000 home, thinking it’s a worthwhile investment. However, this decision leaves him spending half of his income on housing expenses. With no extra money to invest and living paycheck to paycheck, Mike constantly worries about meeting his financial obligations. Over 8 years, Mike gains some equity in his home, but because all his resources are tied up in his mortgage, he has no savings or investment growth to show for it.

The Long-Term Wealth Difference

Now, let’s fast forward to retirement. Emily continues to invest her $1,000 monthly, and after 30 years, her investments have ballooned to over $2 million with the help of compound growth at a 10% annual return. This gives Emily plenty of flexibility in her retirement, ensuring that she’s not dependent on just her home equity but has substantial liquid assets for emergencies, travel, or even early retirement.

Meanwhile, Mike, while owning a larger home with some equity, doesn’t have the same kind of financial security. He’s still relying heavily on the value of his home, which is a less flexible asset, and he’s missed out on the long-term investment gains that Emily has enjoyed. His financial future is more uncertain, with limited options for retirement income.

Let’s Look at the Numbers

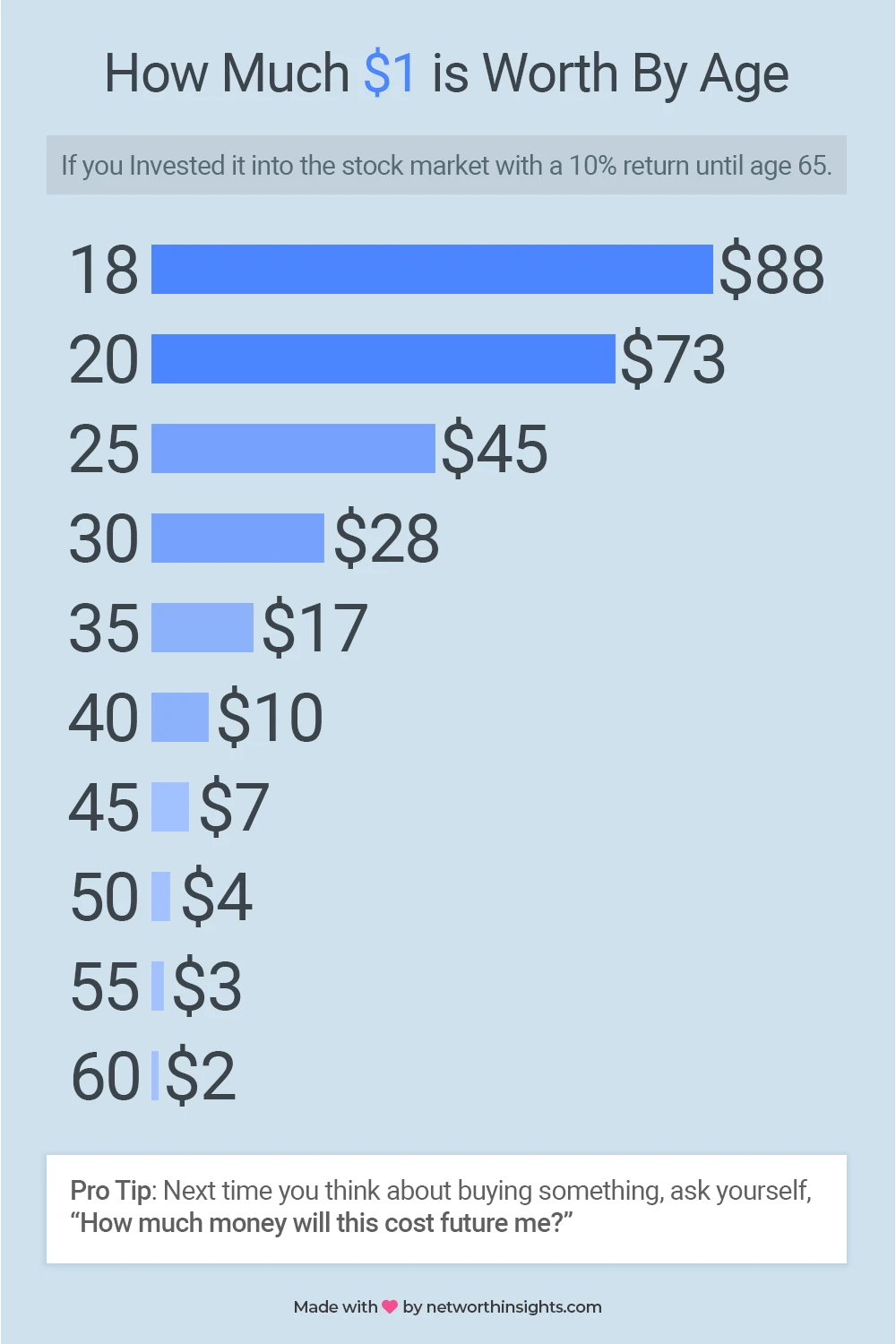

Every dollar you invest early in the stock market holds significantly more value over time. Even if you decide to sell your starter home and upgrade later, the money you’ve invested in the market will grow at a faster pace due to compounding returns. As shown in our chart, each dollar invested now can grow into as much as $88 by retirement. Starting early allows your investments to multiply over time, giving you a huge financial advantage in the future.

The Wrap-Up: Smart Decisions Now, Big Gains Later

The lesson here is clear: big financial decisions, like buying your first home, can have a huge impact on your long-term wealth. By choosing a more affordable home and investing the difference, Emily set herself up for financial freedom. Mike, on the other hand, stretched his budget and paid the price in lost investment opportunities.

The bottom line? Smart, conservative choices early on can create the kind of wealth that allows for financial freedom and security. Don’t be afraid to start small—your future self will thank you!