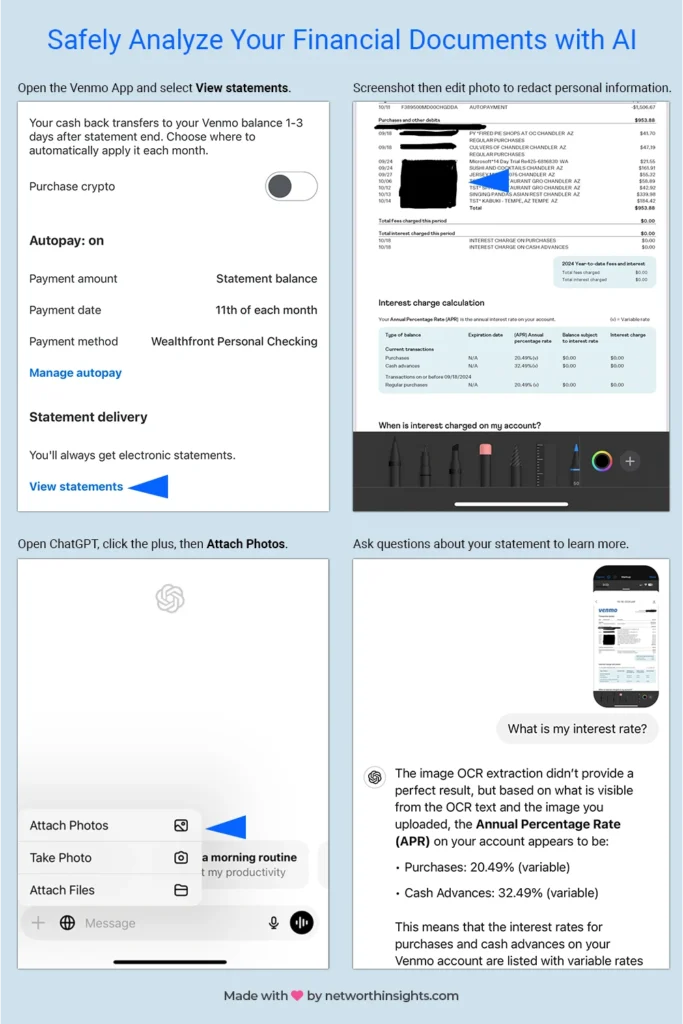

Credit card statements can be confusing. They have numbers, charges, and terms that aren’t always easy to understand. But don’t worry—ChatGPT can help! Think of it as your friendly guide to make sense of what you owe and how to stay on top of your spending.

What’s on Your Credit Card Statement?

First, let’s break down what you’ll see:

- Balance Due: This is how much you owe on your card.

- Minimum Payment: This is the smallest amount you need to pay to avoid fees.

- Interest Rate (APR): This shows how much extra money you’ll owe if you don’t pay the full balance.

- Transaction List: This lists everything you bought with your card.

How ChatGPT Can Help You Understand It

Explain Complicated Terms

If there’s a word or number you don’t understand, just ask ChatGPT! For example, “What does APR mean?” or “Why do I have a late fee?” ChatGPT can give you easy answers so you can understand exactly what’s happening.

Help You Spot Mistakes

Sometimes, there might be errors or charges you don’t recognize. If you see something strange, you can ask, “Why is there a $50 charge on my statement?” ChatGPT can help you think about where it might have come from or if you need to call your credit card company.

Show You How to Pay Less Interest

If you don’t pay off your whole balance, you’ll be charged interest. Ask ChatGPT, “How can I pay less interest?” It can give you tips like paying more than the minimum amount or making payments earlier.

Help You Make a Plan to Pay Down Debt

ChatGPT can guide you in making a plan to pay off what you owe. If you have a large balance, it can offer strategies like the “snowball method” (where you pay off smaller debts first) or the “avalanche method” (where you pay off the highest-interest debt first).

Remind You About Due Dates

Missing a payment can cost you money. ChatGPT can help you set reminders to pay on time so you don’t have to worry about late fees or damage to your credit score.

Tips for Using ChatGPT With Your Statements

- Ask Specific Questions: Be clear about what you need help with.

- Check for Updates: Credit card terms can change, so always double-check any advice.

- Use ChatGPT as a Helper, Not a Replacement: It’s great for learning, but still check your statements carefully!