In today’s digital age, managing your finances often means handling sensitive documents online. While AI tools can help you analyze your financial records for insights and advice, it’s essential to ensure your data remains private and secure. Scanning your financial documents with AI can simplify complex calculations, offer quick answers, and even help you make smarter decisions with your money. But before uploading or analyzing any data, you need to take the necessary precautions to protect your sensitive information.

This step-by-step guide will walk you through the process of safely scanning and analyzing your financial documents using AI tools. We’ll cover everything from accessing and redacting your financial statements to securely uploading your data. By following these practical steps, you can harness the power of AI while keeping your personal information out of harm’s way. Let’s dive into how you can protect your data, safeguard your privacy, and still get the most out of AI-powered insights.

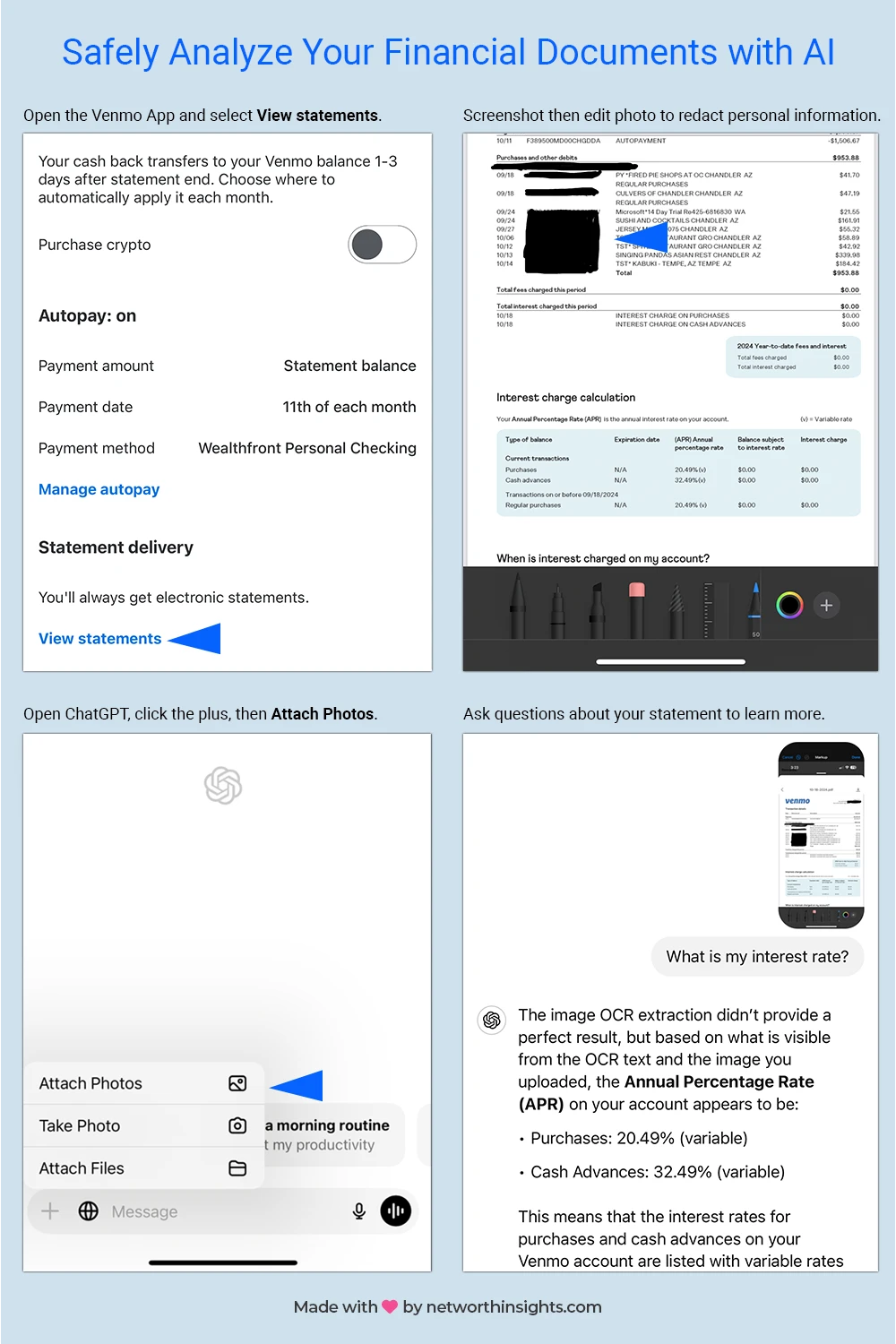

Overview Infographic

Step-by-Step Breakdown

Access and View Your Statements

- Start by opening the app where your financial documents are stored. For this guide, we’ll use Venmo as an example.

- Select “Cards” from the bottom navigation and click on your Venmo Credit card.

- Click on your card graphic.

- Scroll to the “Statement delivery” section and click “View statements” to view your statement.

- Click on a transaction period.

- Then select “-Get billing statement” to show and generate a pdf.

Pro Tip: Ensure that your device is secured with a strong password or biometric login for additional safety. It is also a good idea not to send these photos automatically to external services until they are redacted.

Take Screenshots

Capture Your Document: Once you open your statement, take a screenshot of it. Make sure the relevant information is visible.

Pro Tip: If needed, you can take multiple screenshots and strategically cut off certain personal information, which will make it less likely to redact on the next step.

Redact Personal Information

Edit the Image: Use a photo editor on your phone or computer to block out sensitive data such as your account number, address, or transaction details that you don’t want to be visible.

- Use Tools: Tools like the ‘pen’ or ‘highlighter’ can help you blackout or blur sensitive areas before sharing or uploading any information.

- Pro Tip: Double-check your redactions. Make sure the information cannot be revealed through layers or filters in the image.

Securely Upload to AI Tools

Attach Your Redacted Image(s): Open an AI tool like ChatGPT and start a new conversation. Click on the plus icon and choose “Attach Photos” to upload your redacted statement parts.

Ask the Right Questions

Ask Your Questions: Once uploaded, you can ask questions about the data without exposing your sensitive information. For example, you can inquire about interest rates or transaction details while ensuring your personal details remain private.

Example Questions:

- What is my current interest rate?

- What is the total balance I owe?

- When is my payment due, and what is the minimum payment?

- What are the fees or charges applied this month?

- Can you break down my spending categories (e.g., groceries, dining, travel)?

- What is the interest charged on my balance?

- Are there any rewards or cash-back balances available?

Key Takeaways for Data Security

- Keep Apps Updated: Ensure the apps and tools you use are updated for maximum security features.

- Redact Data: Always remove or cover sensitive information before sharing any document.

- Use Secure Connections: When uploading data, make sure you are using a secure, encrypted connection (look for “https” in the URL).

- Be Mindful of Sharing: Only use trusted AI tools to handle your financial documents and avoid sharing with unverified sources.

By carefully following these steps, you can use AI tools to analyze and gain insights from your financial documents while ensuring your data remains protected and private. Stay secure and smart!