Building a strong credit history is crucial for financial health. It affects your ability to secure loans and the interest rates you receive. It can even impact job opportunities and rental applications. Here’s a guide on how to build your credit responsibly, tailored for both credit card users and non-users.

There are two types of people in this world!

There are those who can use a credit card responsibly and those who can’t. There is a single question I like to use to determine which side of the fence someone is on.

Have you paid at least one penny to credit card interest or any other negligent fees in the past 12 months?

If the answer is yes, then you are not a credit card person. If you still don’t buy it, feel free to take our quiz. (Are you a credit card person?)

Credit Card Person – Build Your Credit

1

Choose the Right Card

- Research: Start by choosing a credit card that suits your needs. Consider a secured credit card if you are starting without credit. These cards require a cash deposit that typically serves as your credit limit.

- Rewards and Fees: Opt for a card with low fees and rewards that match your spending habits, such as cashback on groceries if you spend heavily in that category.

2

Use Credit Sparingly

- Limit Use: Use your card for a few, planned purchases each month. For instance, you might decide to use it solely for gas or groceries.

- Small Balances: Keep balances low to avoid accruing high interest. This demonstrates that you can handle credit without relying heavily on it.

3

Pay Balances in Full and On Time

- Full Payments: Always aim to pay your statement balance in full to avoid interest charges. This not only saves you money but also shows that you are a responsible borrower.

- Timeliness: Set up alerts or automatic payments to ensure you never miss a payment deadline. Late payments can significantly hurt your credit score.

4

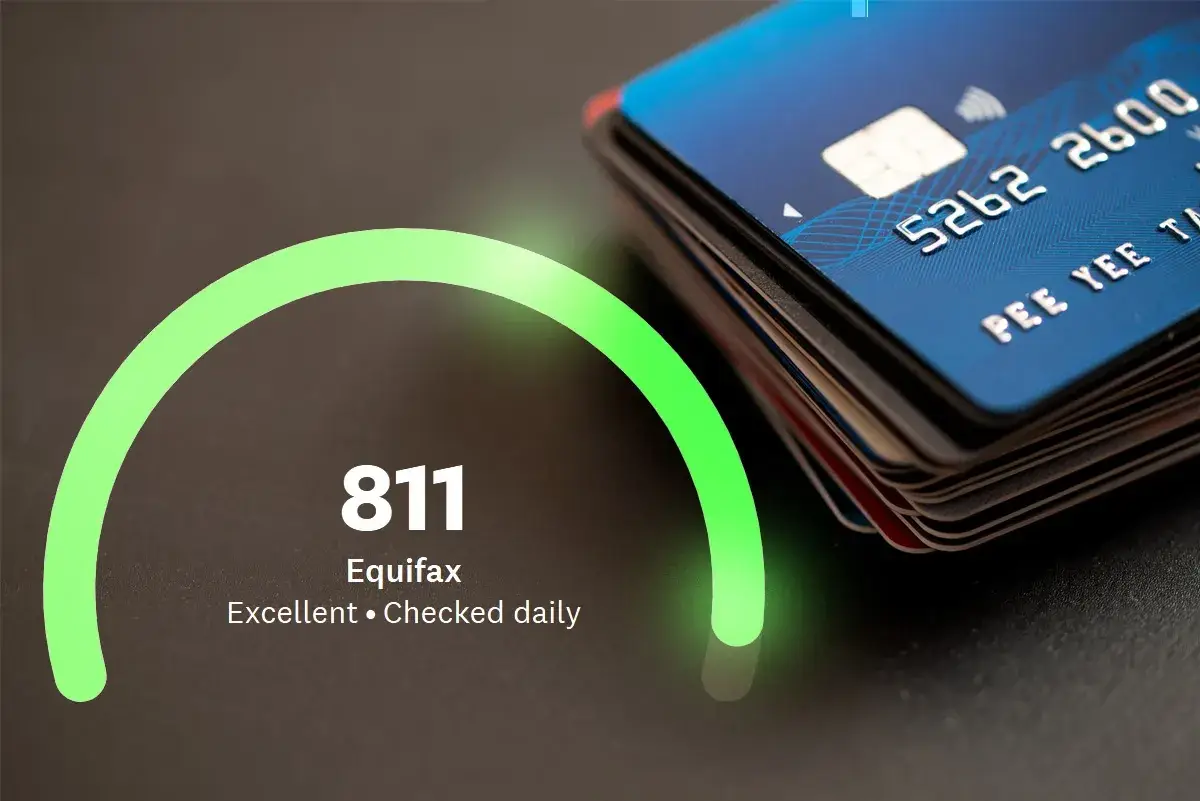

Monitor Your Credit Score

- Regular Checks: Use free services offered by credit card companies or websites to check your credit score regularly. This will help you understand how your actions affect your score and allow you to correct any errors.

Non-Credit Card Person - Build Your Credit

1

Use a Debit Card that Build Credit

- Fizz Card: The student debit card that builds credit. No fees or interest, overdue bills with Daily Autopay, no overspending with smart spend limits, and earn rewards while spending. Get Fizz Card

2

Use Credit Builder Loans

- Purpose: These loans are designed specifically to build credit. The money you borrow is held in an account while you make payments. Once fully paid, you receive the money back.

- Availability: Check with local credit unions or community banks, which are more likely to offer credit builder loans.

3

Pay Loans Diligently

- Timely Payments: If you have student loans, a car loan, or a mortgage, consistently making payments on time can help build your credit.

- Loan Management: Never skip payments and consider setting up automatic payments to avoid lapses.

4

Report Regular Payments

- Alternative Data: Services like Experian Boost allow you to add utility and phone bill payments to your credit report. Regular, on-time payments of these bills can positively impact your credit score.

5

Monitor Your Credit Report

- Annual Checkup: Use AnnualCreditReport.com to check your credit report for free once a year from each of the three major credit reporting agencies. Ensure there are no inaccuracies or fraudulent activities.

Conclusion

Whether you are a credit card user or not, building and maintaining good credit is essential. For those using credit cards, it’s about managing your card responsibly—keeping low balances, paying off debts in full, and monitoring your credit score. For non-users, leveraging other forms of credit like authorized user statuses, loans, or payment reporting services can equally contribute to a robust credit history. Remember, the key to building credit is consistency and responsibility in financial behaviors.