If you’ve switched jobs a few times over the course of your career, you might have multiple 401(k) accounts scattered across different employers. Consolidating these accounts into a single retirement plan is crucial for several reasons. Rolling over your old 401(k)s can simplify your financial management, reduce administrative fees, and provide a clearer picture of your retirement savings. Moreover, having your funds in one place makes it easier to develop a cohesive investment strategy that aligns with your long-term financial goals. By taking the time to find and roll over your old 401(k) accounts, you can ensure that your retirement savings are optimized and working hard for your future.

Hard Way: Manually Finding and Rolling Over Your Old 401(k)s

If you’ve changed jobs a few times, chances are you’ve accumulated multiple 401(k) accounts. Consolidating these accounts into a single retirement account can streamline your finances, reduce fees, and simplify your investment strategy. Here’s a step-by-step guide to finding your old 401(k)s and rolling them over manually.

1

Locate Your Old 401(k) Accounts

- Check Your Records: Start by reviewing any old pay stubs, tax returns, or statements from previous employers. These documents can provide details about your old 401(k) plans.

- Contact Former Employers: Reach out to the human resources or benefits department of your former employers. They can provide information on your 401(k) accounts and guide you on how to access them.

- Use the National Registry of Unclaimed Retirement Benefits: This free service helps individuals find unclaimed retirement benefits. Simply enter your Social Security number to see if any 401(k) accounts are listed.

- Check Your Mail: Look through old mail for any statements or letters from plan administrators. These often include important details about your accounts.

- Use Online Tools: Websites like the Department of Labor’s Abandoned Plan Database can help locate old 401(k) accounts that have been turned over to the government.

2

Decide Where to Roll Over Your 401(k)

- New Employer’s 401(k) Plan: Check if your current employer’s 401(k) plan accepts rollovers. This option can be convenient and may offer better investment options and lower fees.

- Individual Retirement Account (IRA): Rolling over your 401(k) into an IRA provides more investment choices and greater control over your funds. You can open an IRA with a financial institution, brokerage, or robo-advisor.

3

Initiate the Rollover

- Contact Your 401(k) Plan Administrator: Request a direct rollover, where the funds are transferred directly from your old 401(k) to your new 401(k) or IRA. This helps avoid taxes and penalties.

- Complete the Necessary Paperwork: Fill out any forms required by your old 401(k) plan and your new retirement account provider. Ensure all information is accurate to avoid delays.

- Follow Up: Monitor the process to ensure the funds are transferred correctly. It may take a few weeks for the rollover to be completed.

- Invest Your Funds: Once the rollover is complete, choose your investments based on your retirement goals, risk tolerance, and time horizon.

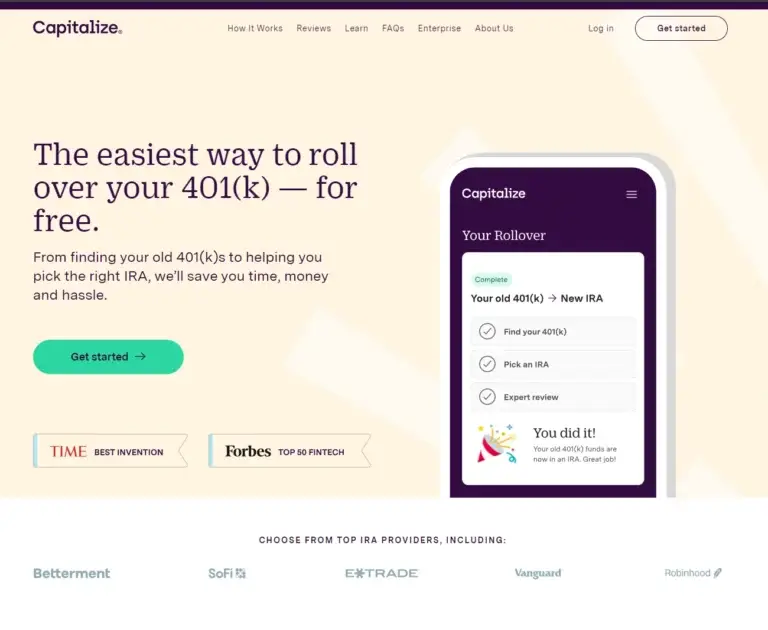

Easy Way: Using Capitalize to Roll Over Your 401(k) for Free

If the idea of tracking down old 401(k) accounts and handling the rollover process sounds daunting, you’re not alone. Many people find the process overwhelming and confusing. Fortunately, Capitalize offers a simple and free solution to help you manage your 401(k) rollovers effortlessly.

What is Capitalize?

Capitalize is a financial technology company that specializes in 401(k) rollovers. Their mission is to make it easy for individuals to find and consolidate their old 401(k) accounts into a new retirement account without the hassle and confusion.

How Capitalize Works

1

Sign Up for Free

Visit the Capitalize website and create a free account. You’ll be guided through a simple, user-friendly process to get started. Get Started Here

2

Locate Your Old 401(k) Accounts

Provide some basic information about your previous employers. Capitalize will use this information to track down your old 401(k) accounts.

3

Choose Your New Account

Decide where you want to roll over your 401(k) funds. Capitalize can help you open a new IRA or transfer your funds to your current employer’s 401(k) plan. They offer comparisons and recommendations to help you make an informed decision.

4

Initiate the Rollover

Once you’ve chosen your new account, Capitalize handles the paperwork and communication with your old 401(k) plan administrators. They ensure that the rollover process is smooth and that your funds are transferred correctly.

5

Sit Back and Relax

Capitalize takes care of the entire rollover process for you. They keep you informed with regular updates and provide customer support if you have any questions or concerns.

Benefits of Using Capitalize

- Free Service: Capitalize does not charge any fees for their rollover services. They are compensated by the financial institutions they partner with, allowing them to offer their services at no cost to you.

- Expert Guidance: Capitalize’s team of experts provides personalized assistance and advice throughout the rollover process, ensuring that you make the best decisions for your retirement savings.

- Time-Saving: By handling the entire process for you, Capitalize saves you time and eliminates the stress associated with finding and rolling over your old 401(k) accounts.

- Security and Privacy: Capitalize prioritizes the security and privacy of your personal information, using industry-standard encryption and security protocols.

Using Capitalize to roll over your old 401(k) accounts is a convenient and stress-free way to consolidate your retirement savings. Whether you prefer a hands-on approach or want to sit back and let the experts handle it, Capitalize offers a reliable and efficient solution. With their free service, you can ensure that your retirement savings are managed effectively, giving you peace of mind and helping you stay on track for your financial goals.