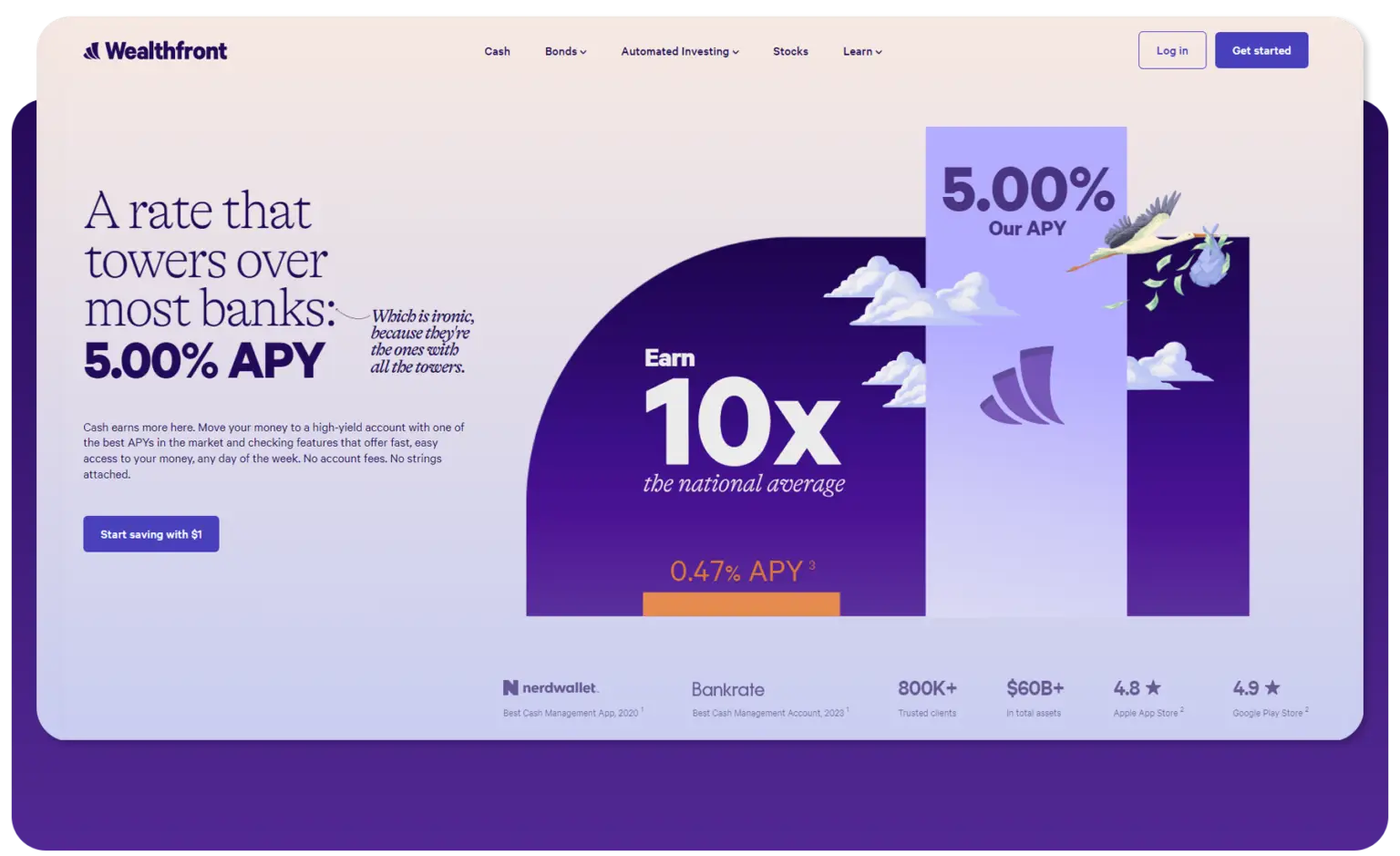

In the modern financial landscape, where every penny counts, finding the right home for your hard-earned money is crucial. You have probably heard of a high-interest savings account, but what about a high-interest checking account? Well, Wealthfront has created a powerful solution with this impressive financial combo attack. With the Wealthfront Cash Account, get all the features of a checking account with the bonus of providing an APY (Annual Percentage Yield) of 5.00%.

Pros and Cons: Wealthfront Cash Account

Pros

High Interest Rates

Wealthfront often offers competitive interest rates compared to traditional savings accounts, making it an attractive option for earning more on your cash reserves. No minimum or maximum balance restrictions to earn the attractive 5.00% APY.

No Account Fees

The account comes with no monthly fees, no account minimums, and no overdraft fees, which can help save money that would otherwise go to bank charges.

FDIC Insurance

Funds in Wealthfront Cash Accounts are FDIC insured up to $8 million through partner banks, which is significantly higher than the standard $250,000 insurance at a single bank, providing a high level of security for your deposits.

Automated Features

Wealthfront offers features like automatic transfers to help you manage your savings effortlessly, aligning with the service’s overall emphasis on passive, hands-off wealth management.

External Integrations

Use your Wealthfront Cash Account with popular payment apps like Venmo, CashApp, PayPal, Apple Pay, and Google Pay. For seamless integration, also use Rocket Moeny, Robinhood, and anywhere that integrates with Plaid.

Nationwide ATM Network

Access cash at a nationwide network of 19,000 fee-free ATMs. Look here (https://www.wealthfront.com/find-atm):

Cons

Limited Physical Branch Access

As an online-only financial institution, Wealthfront does not offer physical branches, which can be a drawback for those who prefer in-person banking services.

Limited Checking Features

While it functions similarly to a checking account, it lacks some features, such as writing checks directly from the account. (You can set up an automated process to send a check on your behalf, which is excellent for paying old-fashioned bills.)

No Lending Services

Wealthfront primarily focuses on investment and cash management and does not offer lending products like personal loans, mortgages, or credit cards, which might require maintaining relationships with other financial institutions. (I actually appreciate this, it means they aren't screwing over people.)

No Zelle Integration

It might seem small, but I personally use it all the time. (There has been interest on Reddit. It was rumored to be on the roadmap, but without an ETA, it's unlikely it be released anytime soon.)

Conclusion

The Wealthfront Cash Account is well-suited for individuals looking for a high-yield, fee-free online banking solution with excellent insurance coverage. It is especially attractive for those who already use Wealthfront for investment services and want an integrated financial management experience. However, the lack of physical branches and ATM access, as well as the limited checking capabilities, may be significant downsides for those who need more traditional banking services. Before choosing, consider how the features align with your financial habits and goals.